An article in the Financial Times last week caught my attention:

Asia to cut subsidies as oil hits $135

By Kathrin Hille in Taipei, John Burton in Singapore and Raphael Minder in Hong Kong

Published: May 22 2008

"Asian governments on Thursday moved to cut energy subsidies to protect their finances and those of state-owned energy companies in the face of soaring oil prices. As crude oil pushed through $135 a barrel for the first time, Taiwan, Malaysia and Indonesia announced plans for urgent action to free prices or cut subsidy costs. China denied rumours of an imminent increase in retail prices, but may relax price controls."

I wrote about the beginning of the end of subsidies in my blog post from May 13. As consumers in Asia begin to pay higher or even market prices for gasoline and other refined products, the effect on demand will be staggering. This process will not occur overnight but will eventually filter its way into the overly optimistic demand projections in emerging economies.

Article Highlights

Taiwan

"In Taiwan, the first act of the newly elected administration of President Ma Ying-jeou was to abolish price controls on petrol and diesel from June 1. The new government also said it would raise electricity prices in July."

Malaysia

"Malaysia said it would soon announce a new petroleum subsidy scheme to keep its fuel subsidy bill at around last year’s level of M$40bn ($12.5bn) in spite of rising oil prices....also suggested that the government would take the unpopular step of raising electricity tariffs. “If there is a rise in the price of [natural] gas, we will have to pass that along, since we are not going to see Tenaga [the state power monopoly] lose money,” he said."

Indonesia

"The Indonesian government said it would “soon” go ahead with a plan to raise fuel prices by an average of 28.7 per cent."

China

"The Chinese government said that stock market rumours of an imminent increase in domestic fuel prices were “groundless”. However, analysts forecast that Beijing would eventually endorse subsidy cuts."

Full Article

Other countries not discussed in this article are also ending subsidies:

"Egypt - the most populous Arab state - has raised petrol prices by 40pc, despite protests in Cairo.

"Sri Lanka lifted diesel and petrol prices by 25pc over the weekend."

"India may have to follow soon to prevent its trade and budget deficits climbing to dangerous levels. "The situation is alarming. We need to stem the rot," said India's energy secretary, MS Srinivasan."

Friday, May 30, 2008

The Second Leg of Demand is Threatened

Posted by

TJF

at

7:00 AM

0

comments

![]()

Labels: Fuel Subsidies, Oil, Oil Prices

Thursday, May 29, 2008

They Say It's Your Birthday

"They say it's your birthday

It's my birthday too, yeah

They say it's your birthday

We're gonna have a good time

I'm glad it's your birthday

Happy birthday to you."

- The Beatles

And it is today - I am 46 years old. I used to get a cake at my old job and it was nice to have even though we all kind of took it for granted. Now that I am on my own, I have to buy my own cake. So a thank you to Allison at my old shop who used to get the birthday cakes for the office.

Posted by

TJF

at

9:03 AM

4

comments

![]()

Wednesday, May 28, 2008

Thrift Industry Quarterly Report

The Office of Thrift Supervision (OTS) released its first quarter report on the 1,276 thrifts that it supervises. The report showed the effects of the deteriorating credit cycle on bank balance sheets. We have written previously on this quarterly report here, and it is important in monitoring the state of the industry.

All data is as of 3/31/2008.

1) Average capital ratios are still strong, some even increased from the end of 2007. There are still outliers on the ratio scale but it is encouraging to see overall strength:

Total Risk Based Capital Ratio - 14.6%

Tier One Risk Based Capital Ratio - 12.5%

Equity Capital Ratio - 9.1%

Tier One Core Capital Ratio - 8.5%

2) The industry has reserved 2.01% of its assets, or $7.6 billion for the coming storm of losses.

3) Troubled assets are now 2.06% of assets. This category includes noncurrent (90 days or more past due), nonaccrual status loans and other real estate owned (OREO). This has not yet peaked and will continue to increase during 2008.

4) The total percent of non current loans continues to rise, reaching 1.78% of assets. The most problems are coming in the category of Construction and Land loans where 6% of all loans are non current. However, this is only 3.5% of all loans held by thrifts. Unfortunately, 1-4 Family loans represent 49.4% of all loans held by thrifts, and delinquencies here are at 2.85% and rising.

5) There are another 1.33 percent of total loans past due by 30 to 89 days. Many of these loans will eventually filter into the non current and OREO categories.

6) Another "bright" spot, if you can use that term, is that the number of banks on the OTS watch list is only at 12. For a bank to qualify for this list it must have a CAMELS rating of 4 or 5. The CAMELS rating is a ratings system that examines capital adequacy, asset quality, management, earnings, liquidity, and sensitivity to market risk. In 1992, the number of banks on this watch list was 203, or 11% of all thrifts.

Read the Full Report by clicking below:

Press Release

Chart Package

Posted by

TJF

at

9:52 AM

0

comments

![]()

Labels: Bank Failures, Banks, Office of Thrift Supervision, OTS

Tuesday, May 27, 2008

Peak Demand?

Everyone talks mercilessly about Peak Oil, but is it time to introduce the concept of Peak Demand? At least in the United States? The Federal Highway Administration (FHWA), a part of United States Department of Transportation (DOT) released its monthly "Traffic Volume Trends" report last Friday.

The report showed that estimated vehicle miles traveled (VMT) on all U.S. public roads for March 2008 fell 4.3 percent as compared with March 2007 travel. The report also said it was the first time March travel on public roads fell since 1979.

The 11 billion mile drop in March 2008 compared to March 2007 was the sharpest yearly drop for any month in FHWA history. This report was first issued in 1942, so there is 66 years of data.

The negative demand trends should continue in April and May since gasoline prices have moved up sharply from March.

Predictably the market ignored the report, and no doubt oil bulls spent all weekend mining the data for something to support the bull case.

The perfect storm seems to be brewing for Oil demand domestically right now. The main use of Oil in the United States is for transport, and we are starting to see the effects of high gasoline prices on demand as people drive less. If that wasn't bad enough, ethanol production is starting to take market share from gasoline, leading to even less demand for oil.

We put forth our opinion on the fundamentals for oil in our previous post on May 12.

We still maintain that fundamentals don't support current prices for oil. Emerging economies don't matter. What matters is world wide supply and demand for the commodity, and as we stated earlier, a 5% drop in demand in the United States would translate to a decline in demand twice China's oil consumption growth last year.

Read the Press Release.

Posted by

TJF

at

9:23 AM

0

comments

![]()

Labels: Federal Highway Administration, FHWA, Oil, Oil Prices

Thursday, May 22, 2008

CKX Land Mysterious Price Spike Explained

The mystery of CKX Land has been solved. On Tuesday, CKX Land (CKX) spiked up in price from $13 to $24.50 per share leaving me flabbergasted and a little wealthier. I dumped my entire position and then watched it fall back to the $14 range. So what’s the answer to the mystery? It’s an oil and gas company!! Every small cap energy stock out there spiked up in price. It was my mistake to try to find a fundamental reason behind it. Oh wait...the price for an asset always reflects its fundamental value, doesn't it? There's never any speculative money pushing the price up above its intrinsic value? No way, that couldn't happen.

Here are some others that spiked up. Most of these I have never heard of and none of them I own.

Blue Dolphin Energy Co.

BPI Energy Holdings

Tengasco Inc.

Venoco, Inc.

Samson Oil & Gas Limited

Fieldpoint Petroleum Corp.

Now my two favorites:

Mexco Energy Corp.

Pyramid Oil Co.

So what's the point of this diatribe? A stock can trade above its true or intrinsic value - it happens all the time. A cynical value investor like myself would say most of the time. So why can't a commodity trade above its true or intrinsic value?

Posted by

TJF

at

8:27 AM

3

comments

![]()

Labels: BDCO, Blue Dolphin Energy, BPG, BPI Energy Holdings, CKX, CKX Land, Fieldpoint Petroleum Corp, FPP, Mexco Energy Corp, MXC, PDO, Pyramid Oil Co, Samson Oil and Gas Limited, SSN, Tengasco, TGC, Venoco, VQ

Wednesday, May 21, 2008

And the Band Played On

This article came out yesterday:

Iraq could have largest oil reserves in the world.

"Iraq dramatically increased the official size of its oil reserves yesterday after new data suggested that they could exceed Saudi Arabia’s and be the largest in the world. The Iraqi Deputy Prime Minister told The Times that new exploration showed that his country has the world’s largest proven oil reserves, with as much as 350 billion barrels. The figure is triple the country’s present proven reserves and exceeds that of Saudi Arabia’s estimated 264 billion barrels of oil. Barham Salih said that the new estimate had been based on recent geological surveys and seismic data compiled by “reputable, international oil companies . . . This is a serious figure from credible sources.”

Amazing how Oil Bulls ignore any evidence that contradicts the fundamental basis of their argument for higher prices. So basically they will disparage the source of this information. This is what they will say:

1) This guy doesn't know what he is talking about, he probably hasn't left the Green Zone in years.

or

2) Even if he did know what he was talking about, it would take years for the production to come on line.

Yet I keep hearing that the price keeps going up because the market has doubts about the long term supply of oil. Certainly this discovery will go a long way toward solving those long term concerns on supply.

Posted by

TJF

at

4:16 PM

0

comments

![]()

Labels: Oil, Oil Prices

Tuesday, May 20, 2008

Steak n Shake Co. (SNS)

Steak n Shake Co. (SNS) is a casual dining chain with 502 restaurants in 21 states. SNS stands out even in the battered restaurant industry as a particularly poor performer. The stock was at $19 back in Nov 2006 and is now at $6.57.

The company has long been a target of activist investors including Sardar Biglari, who got himself elected to the board of SNS in March. SNS reported earnings last week and they were dismal as expected. During the conference call, management took a beating from a couple of investors, including one who identified herself as the "founder" of the chain. Here are the two exchanges:

Question 1

"Yes, my name is Sue Aramian. I have been asked many, many times to comment upon the company that I co-founded with E.W. Kelley in 1981. I have refused every request until this statement that I am making to you, and I am taking this position at this time for the following reasons. Currently as you know, there is no permanent CEO to lead this company and there has been a vacuum of leadership that has not been corrected. This continued lack of leadership has resulted in a vacuum which in turn has resulted in poor operational results. This fact is indisputable."

"I am aware that the immediate response would be that the board is looking for a replacement. However, shareholders were told in August of 2007 that this search would begin promptly and it is now 10 months since that day and we are still talking about not having a CEO. I was very surprised to learn that it only started in February of 2008."

"Previous earnings over too many years have been disappointing, have been dismal and there is no mention of shareholder value which has diminished in an intolerable manner. I do not even mention dividends as I certainly understand that the board could in no way authorize the distribution when the balance sheet demonstrates that without inflow of money, there can be no outflow."

"However, and importantly, management salaries, director fees, change of controlled severances, G&A expenses, et cetera, have all increased dramatically, which would be justifiable if there was a corresponding value for shareholders. You have operated with the same team doing the same thing getting the same results. These results have brought the company to this undesired state."

"I have informally visited many units recently, discussed the situation with loyal employees who recognized me and asked for anonymity because of fear of losing their jobs. Naturally these employees have great concern; it all stems from lack of good leadership and an understanding and appreciation of the basic concept. I for one am saddened that after many years of continued growth and success, a company which has enjoyed iconic stature in the Midwest is now known as a sick company. I continue to believe in the concept and company. Your report released today again, as in the many past years, underlines this assessment."

Management response from Jeffrey A. Blade

"I don’t believe there was a question in that, so we’ll go on to the next question."

Question 2

David Freeman - Freeman Capital

"This question is for Mr. Blade and Mr. Kelley; you guys have been leading this company for quite some time now and the results have just continued to be dismal, dismal, and it just keeps going down the drain. And I can’t see how it can get any worse. And my question to you, and it kind of continues what that other woman was saying before, my question to you is when are you guys going to lead the company so we could start creating some value for this [firm]? Because after so many years, that looks like the only important question at this time to me, because you can’t promote your way out of this problem. There’s service issues, there’s cleanliness issues. So that’s my question to you."

Management response from Wayne L. Kelley

"We appreciate your concern. I will tell you that I don’t think we plan to leave the company anytime in the near future but we do appreciate your concern and interest."

Disclosure - No position.

Posted by

TJF

at

1:42 PM

0

comments

![]()

Labels: SNS, Steak n Shake Co.

CKX Land Gone Crazy?

CKX Land (CKX), one of my favorite stocks is going crazy today. The stock is up 66%, to $22.50 and I don't see any news on the tape about it. The last time this happened, there was news out on CKX Inc. (CKXE), which is the company involved with the American Idol TV show, and one that CKX Land is frequently confused with by investors. I just sold half my position.

Posted by

TJF

at

10:13 AM

1 comments

![]()

Monday, May 19, 2008

A Couple of Cheap Retailers

Here are two cheap retailers that fill three requirements, they have large amount of cash, little or no debt and have sold off significantly the last year. Can they get cheaper? Sure, but as a former co worker of mine used to say, "you got to own something."

The first up is Charlotte Russe Holding, Inc. (CHIC) - it has $125 million in cash, or about $5.00 per share, as of 3/29/08. After the quarter ended, CHIC bought back 16% of its shares for $73.4 million. This reduced its cash balance to $52 million, still a nice nest egg, and no debt. The stock has lost about half its value over the last year, and is at $17.87.

The second stock is Christopher Banks (CBK). The company has $78.5 million as of March 1, 2008. Unfortunately for them, another $24.5 million is locked up in Auction Rate Securities. The share count is 35 million, so depending on what you use as your numerator, the company has either $2.00 or close to $3.00 per share in cash. The stock peaked at $30 and is now at $10. No debt either for them.

Disclosure - No position in either of these.

Posted by

TJF

at

11:35 AM

0

comments

![]()

Labels: CBK, Charlotte Russe Holding, Christopher Banks

So Which Is It?

Saudis to boost oil output after US pressure

By Javier Blas in London and Andrew Ward in Washington

The Financial Times

May 16 2008 14:06 | Last updated: May 17 2008 00:27

"Saudi Arabia said on Friday that it was increasing its oil production to its highest level in two years, bowing to intense US pressure after the price surged to a fresh record of almost $128 a barrel."

or

Saudis Rebuff Bush on Oil

By JOHN D. MCKINNON, STEPHEN POWER and NEIL KING JR.

May 17, 2008

The Wall Street Journal

"The Saudi king rebuffed President Bush's request for higher oil production, in the latest sign of how U.S. leaders are struggling to combat soaring energy costs that have become a major election-year issue."

or

Does it not matter because Oil Bulls don't believe that the Saudis can raise production anyway?

or

Does it not matter because Oil Bulls believe there is infinite demand for Energy - if you pump it, they will buy it?

Posted by

TJF

at

6:33 AM

0

comments

![]()

Labels: Oil, Oil Prices, Saudi Arabia

Wednesday, May 14, 2008

ANB Financial is Gone

ANB Financial, a bank out of Arkansas, was taken over by the Federal Deposit Insurance Corporation (FDIC), on May 9. The failure cost the FDIC $214 million.

An astounding 19.37% of assets were in nonaccrual status, as of 12/31/2007, with most of the problem loans in construction and land development. Another 3.1% were more than 30 days past due. By the end of March 2008, non accruals were at 35%.

Here are the capital ratios as of 03/31/2008.

Core capital (leverage) ratio - 1.89%

Tier 1 risk-based capital ratio - 2.1%

Total risk-based capital ratio - 3.5%

Just to demonstrate how quickly things can turn at financial institutions, here were the ratios just six months earlier.

Core capital (leverage) ratio -9.17%

Tier 1 risk-based capital ratio- 9.70%

Total risk-based capital ratio -10.97%

One item of note is that the bank actually reported a positive net income on its Schedule RI - Income Statement form that it files for the March quarter.

Another interesting item is that ANB Financial paid dividends right up until the end. In the year ending 12/31/2007, it paid $13.3 million in cash dividends.

The bank also received a capital infusion from the parent holding company during 2007, sometime before June in the amount of $29.5 million. It didn't help.

The press release is here at the FDIC site.

Posted by

TJF

at

11:15 AM

0

comments

![]()

Labels: ANB Financial

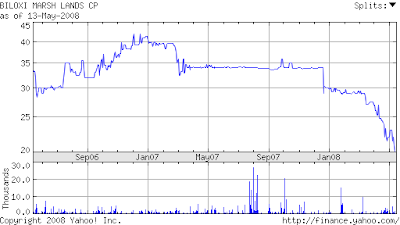

Biloxi Marsh Lands Company (BLMC.PK)

Biloxi Marsh Lands Company (BLMC.PK) is an intriguing company. I wrote a few posts on it last year, and it fell off my radar screen. It is currently selling at $20, which is a four year low. The company trades in the Pink Sheets but is a very transparent and open company, with regular SEC filings, a web site, and it makes efforts to reach out to the investment community.

BLMC.PK owns approximately 90,000 acres of wetlands in St. Bernard Parish, Louisiana. The land has no development potential but portions have been leased for mineral exploration since the 1930's. The company is transitioning from that of a royalty company to one with a more active role in exploration.

The company recently put detailed information on its website on two potential prospects on its land, at the NAPE EXPO in February 2008. Here is a link to the press release.

A summary of the two prospects, entitled "Alpha" and "Beta."

Prospect Area “Alpha”

1) 170 BCF of Natural Gas Reserve Potential

2)3D seismic Amplitude Anomalies including a classic “Gator-Mouth” Anomaly conforming to Structure

3) Multiple Fault Blocks covering +/- 1,500 acres

4) Average net sand thickness 150’

5) +/- 2,000 acres controlled

6) Multiple well development potential

Prospect Area “Beta”

1) 300 BCF of Natural Gas Reserve Potential

2) +/- 5,000 acre structure shown on 3D seismic

3) Documentation of sand and hydrocarbons present in original well

4) Original well failed upon flow test due to improper completion

5) Baker Hughes completion analysis indicates deeper perforations and gravel pack will aid in sand control

6) Average sand thickness 40’ net over +/- 5,000 acre structure

7) +/- 5,200 acres controlled

8) Multiple well development potential

BLMC.PK has no debt and $8.8 million in cash, $4.6 million in marketable debt and equity securities that are carried at cost, and $2.2 million in other investments. They paid a $1.00 dividend in 2007, the entire amount at year end.

I need to do some more research on this one before taking a position but it is interesting that the price has been cut in half while natural gas prices have been moving up.

Posted by

TJF

at

9:22 AM

1 comments

![]()

Labels: Biloxi Marsh Lands Company, BLMC, BLMC.PK

Tuesday, May 13, 2008

Is Oil the New Globe.com?

Here is why Oil shouldn't go to $200 a barrel. Notice I didn't say won't go to $200, as betting against a commodity in this market is tantamount to financial suicide.

1) The fundamentals don't support an accelerating price for Oil. While the U.S is not officially in a recession, growth has slowed down here as well as in the rest of the world. Less economic growth means less demand for Energy. Has supply changed in the last month? Only in the minds of those bulls who believe any time a gun is fired in an oil exporting nation, supply is threatened.

2) The elasticity of demand for Oil may not be linear - that is to say that each 1% increase in the price reduces demand to a different extent. Is it possible that the higher the price, the more demand impact occurs? It is not inconceivable that demand for oil worldwide could flatten out for several years - it has happened before.

3) Many countries subsidize the price of refined products to its citizens to promote social stability. As the price of Oil moves up, the cost of these subsidies increases to the point where it is no longer economically feasible to do so. Once these subsidies are reduced or eliminated, the impact on demand may be tangible. Turkmenistan recently ended subsidized gasoline for its citizens, and others will follow suit as the price of Oil goes higher. While demand from Turkmenistan is negligible in the world market, many countries use subsidies, including China. China, is in effect, hurting itself by shielding its people from increasing prices. Since demand doesn't fall internally as prices rise, this leads to even higher prices.

4) Although demand for Oil is inelastic in the short term due to a lack of substitution, there is a "crowding out effect" as consumers pay up more for gasoline, they will cut back on purchases of consumer items and other discretionary purchases. This will cause a further decrease in demand for Oil since many products use Oil in the manufacturing process. Many of these products and items are made in China, which still relies heavily on exports. So won't this "crowding out effect" eventually reach the end of the supply chain, and cut demand for Oil?

5) The price of Oil is firmly in the hands of speculators and financial players as everyone knows. This is difficult to prove, but it is clear that technical reasons and momentum are keeping the price elevated. As a trader on the floor said this morning on Bloomberg, the market wants to go up. And we all know that what the market wants, the market gets, at least in the short term. When this momentum ends, the impact will be staggering.

6) Much is made of the growth in demand for Energy from emerging economies, but the United States still uses 30% of the world's oil, and lack of growth here will eventually have an important effect on the market. In other words, a 5% growth in demand in the U.S. is worth 1.1 million barrels a day, while China's much hyped up growth of 7% was only worth 600,000 barrels a day. What if demand in the U.S declined 5%? Could China make that up?

7) Another important reason is less analytical - take a look at the people that are telling you that everything will be OK with Oil in particular, but also with Commodities in general. That prices will stay high. Do they look familiar? They should, as they are the same ones who told you that everything would be OK in the housing market and the Homebuilders. Remember that crap? They didn't buy land any more, they "optioned" the land. They had access to capital, etc. None of these reasons stopped Homebuilders from going down 75% from the peak. Consider your source.

8) Another non analytical reason is this - eventually someone in OPEC will stand up at a closed door meeting and say this: is it really wise for us to have oil so high for so long? Won't this eventually lead to permanent long term changes to demand as countries adjust their economies? Won't it stimulate the growth of alternative fuel sources? Or might it cause so much inflation that it will crash the world economy?

What could end the momentum play? Here are a few scenarios:

1) A Democrat in the White House releases oil from the Strategic Petroleum Reserve to bring prices down. The government has twice as much Oil in its inventory as the entire commercial market does. Sure, OPEC might cut production to balance the market, but then there goes the spare capacity argument.

2) A Democrat in the White House pushes a Windfall profit tax through during the first 100 days. This tax is not on Oil companies but on commodity traders and speculators. Or they could push up margin requirements for futures trading on certain commodities.

For those of you who don't remember, the Globe.com, was the poster child for the start of the Internet boom in the late 1990's. It soared way above its true value as money piled into a speculative play. The company is now long gone, and I am not saying that Oil will one day be "long gone," but might there be some lessons we can learn from our past mistakes.

Posted by

TJF

at

5:52 AM

0

comments

![]()

Labels: Oil, Oil Bearish, Oil Prices, OPEC

Monday, May 12, 2008

What's Wrong with this Picture?

Despite National Slowdown, Average NYC Condo/Co-op Prices Go Up 34 Percent

Full Article

By Anuradha Kher, Online News Editor

New York-- The average sales price of condos and co-ops in New York City rose 34 percent to $994,000 in the first quarter of 2008 compared to the same time last year, according to a report recently released by ResidentialNYC.com, a Web portal managed by The Real Estate Board of New York (REBNY)...

And Yet....

Morgan Stanley execs are planning another round of layoffs at the Wall Street firm, this time hitting 1,500 employees - 5/5/08.

Almost 10,000 Additional Job Cuts At Citigroup - 4/18/08.

Merrill Lynch Joins Pink Slip Parade: 3,000 More Employees Cut - 4/18/08.

26,719 jobs in the first quarter alone disappearing in the financial services industry, including Wall Street banks - 4/16/08.

Posted by

TJF

at

10:18 PM

0

comments

![]()

Labels: Layoffs, Wall Street

Festival of Stocks #88 - May 12, 2008

My blog is once again the proud host of the Festival of Stocks. If you don't know anything about the Festival of Stocks go to this link:

Festival of Stocks

It is a great way to promote your blog, so sign up to be a host.

Since it is a Festival of Stocks, we will start of with submissions about stocks.

Stocks

Our first entry is from James Cullen who runs a site called College Analysts. He is a student at Boston College majoring in Finance. His entry is on Ingersoll-Rand, and he likes the stock because of the Trane Deal and thinks the valuation is cheap relative to its growth rate. The full post is at Ingersoll-Rand (IR): Earnings Analysis.

The most loyal reader of my blog is Mark Perkins and his blog is called Stock Pursuit. This week he discusses Investools (SWIM), a controversial company. The full post is here at The Market Is Probably Overreacting to Investools (SWIM).

Jae Jun presents his views on AeroGrow (AERO) on his blog called Old School Value. He is a dyed in the wool Value Investor and the full post is at AeroGrow (AERO) Valuation

Dividend Growth Investor presents a thorough analysis of Dover Corp in his post here Dover Corp (DOV) Dividend Analysis. His main blog is Dividend Growth Investor, where he has many other entries on dividend paying stocks.

Ted Gottsegen weighs in on three stocks in the Metals Industry posted at The Heavy Metal Index: Unstoppable Stocks. The main blog is here at The StockMasters - Investing News and Analysis .

Stock Trader discusses Google in his post entitled Some Thoughts On Google (GOOG) » Free Stock Market Investing Tips. The full blog site is called Stock Tips.

Leon Gettler at Sox First wrotes about AIG and for once I actually agree with something Jim Cramer has to say. The post is at AIG shame file

AndyS at Saving to Invest writes about Melco PBL Entertainment (MPEL), a company that owns a casino in Macau. Read more here at Macau Play : Melco PBL (MPEL) - on the up and worth a gamble

Dividends4Life presents a thorough analysis of the Coca-Cola Company (KO) on his blog Dividends4Life. The full post is here at Stock Analysis: The Coca-Cola Company (KO)

Super Saver updates his readers on his portfolio at his post called Stock Purchase Update 5/5/08 - Google Rallies, Potash Falls. Read more at My Wealth Builder.

Warren Buffett

Only one post on Buffett this week, which is surprising considering the Omaha lovefest last week. Ray presents Warren Buffett’s Single Most Important Piece Of Advice For Stock Market Investors posted at his blog entitled Money Blue Book: Personal Finance Blog.

Sectors

Sajal's blog is called Fundamental insights and ideas (by Sajal). He is pushing the Consumer Staples Sector and expounds on his reasons at Three reasons to buy consumer staples right now! I have to admit that I don't fully understand his reasoning, as it seems that the arguments he gives would lead to more spending on Consumer Discretionary items, boosting those stocks. Read his post and decide for yourself.

Steve Alexander is a believer in the Magic Formula of Investing as popularized by Joel Greenblatt. His blog is called MagicDiligence - Optimizing Joel Greenblatts Value Stock Strategy, and his entry in the Festival is at

Magic Formula Business Sector #6: Consumer Services. Steve discusses the Magic Formula as it applies to this Sector.

Foreign Currency

Sagar Satapathy's blog is called Currency Trading.net, and he is clearly not a fan of Alan Greenspan and his tenure at the Federal Reserve. You can read the full post at 6 Ways Greenspan Caused the Current Economic Crisis.

Investment Strategy/Market Commentary

Ryan Taylor writes a blog called Millionaire Money Habits . Although his portfolio dropped 8% last quarter, he still believes in the advantages of holding stocks for the long term. The full post is at My Portfolio Dropped 8% - How’d Yours Hold Up?

AlexG is a Value Investor and a strong believer in the theory of "smart money" and he preaches that on his blog called Contrarian Value Investing. His post in this week's Festival tracks the investments of David Dreman, a noted and well known Value Investor. The full post is at Tracking David Dreman.

Brice Hogan talks about three main indexes at his post called Stock Market Indexes and Averages | Financialzip.com. His full blog is Financialzip.com.

FIRE Finance discusses the differences between Open and Closed End funds at Closed End Mutual Funds - Should We Stay Away From Them? His full blog is at FIRE Finance.

hank@myinvestingblog.com discusses strategies to pursue to cope with the Bear Market that he believes we are in. The post is entitled What do I do during a bear market? What do I invest in? | My Investing Blog. The main page of his blog is at My Investing Blog.

Kacper Wrzesniewski is a 25 year old from Poland and his blog is called Kacper Wrzesniewski. I think its fair to say that this domain was probably not taken when he went looking. He gives us ten simple rules for investing. Although they may seem quite obvious, many investors in their greed can forget them.

Bull Returns blog is called Stock Investment Resource. His post wades into the age old battle between Value and Growth Investing, presenting an innovative argument that the two are variations of the same strategy. The post is at Stock Investment Resource: Stock Market Investing Tips - Growth vs. Value Investing

GBlogger is working toward financial independence on his blog called CAN I GET RICH ON A SALARY. His entry reviews a book that gives some good advice on investing for the long term. The post is at The First Commandment of Stock Investing, According to Marcial — And How To Apply It

Steve Faber talks about getting your kids started in investing at his post called Investing for Kids. He has more good articles here at Getting Debt Free.

KCLau needs no introduction as he is a frequent contributor to the Festival of Stocks with his blog called KCLau's Money Tips. He discusses the value of insurance and urges people to keep up on your premiums, using a set of spreadsheets to prove its value. The full post is at Don’t be stupid! Keep paying.

The DINKS don't like Mutual Funds and they discuss their reasoning at the post entitled The Drawbacks of Mutual Funds.

In the spirit of shameless self promotion I am including two of my recent posts in the Festival. They are meant to be humorous, so don't take them too seriously but enjoy:

The Ten Commandments of Growth Investing

The Ten Commandments of Value Investing

Posted by

TJF

at

5:46 AM

9

comments

![]()

Labels: Festival of Stocks

Thursday, May 8, 2008

My View of the Stock Market

The direction of the market on a daily basis is set by short term traders. They digest the news in the market that day and then trade based on it. This is not a conspiratorial view of things, it's not as if I believe that they all gather in a room somewhere and decide on where the market goes that day, but it reflects the old Warren Buffett cliche - in the short term the market is a voting machine, in the long run it is a weighing machine. Every day there is an informal vote by short term traders. Keep in mind that these traders can change their mind very quickly, as evinced by the volatility lately in the market.

So what has changed recently is that the voting has been for an up market, and we have seen a rally from 11,500 to 13,000 in the DJIA. The media has proclaimed this to mean that the "worst" of the crisis is over, but in reality nothing has changed except the optimism of the market. In March the market was overly pessimistic, imputing a worst case scenario and now it is doing the opposite, imputing a best case scenario.

We still face the same problems that we had before with Housing, the Economy, the credit crunch, the high price of commodities, etc. So what is the point of this diatribe? Stop listening to the market, because to paraphrase Mr. Bumble in Oliver Twist.

"The market is a ass."

Posted by

TJF

at

10:47 PM

2

comments

![]()

Labels: Mr. Bumble, Oliver Twist, Stock Market

Wednesday, May 7, 2008

Thank You Becky Quick

I mentioned in a previous post here:

Becky Quick vs. Charlie Gasparino

about how much traffic I have generated from this post. Since I wrote it in February 2008, I have received more than 800 visitors from people typing Becky Quick into Google. In fact, my blog is the seventh entry based on this keyword, right on page one with Wikipedia and CNBC. I am not sure what Google Algorithm ranks me up there with these giants of the Internet, but I am not going to make any waves.

Posted by

TJF

at

10:07 PM

0

comments

![]()

Labels: Becky Quick

Are FHA Loans the New Subprime?

I just ran into another tenant in my office building this morning - he is a mortgage broker specializing in sub prime lending. He just moved his office to his house due to the fall off in these types of loans. I asked him how the business was and he mentioned something about the growing popularity of FHA loans, referring to loans either made or guaranteed by the Federal Housing Administration. And then he made a chilling statement with a slight grin on his face:

"You know, FHA is the new sub prime."

He then waltzed out the door, safe in the knowledge that his capital wasn't at risk.

I have to do more research on this type of loan. I know a little bit about it - only 3% down payment required I believe. If anyone knows something about this type of lending, please comment and tell me we are not about to make the same mistakes again.

Posted by

TJF

at

7:39 AM

1 comments

![]()

Labels: Federal Housing Administration, FHA, Mortgages, Subprime Lending

Monday, May 5, 2008

White Mountains Earnings Review

White Mountains Insurance (WTM) reported first quarter 2008 earnings and there were a couple of noteworthy items:

1) WTM released the breakdown of its investment portfolio by method of valuation - Level I, Level II and Level III. The allocation is:

Level I – $ 4.48 billion.

Level II – $ 6.38 billion.

Level III - $ 956.4 million.

The Level III assets are down from $1.22 billion at the end of 2007. This was higher than I expected. Level III assets are those valued with "prices based on assumptions that include significant unobservable inputs."

2) White Mountains Re decided to increase prior year loss reserves by $33 million in the first quarter of 2008. The 2008 reserve addition includes $41 million for late reported construction defect claims at Folksamerica for underwriting years 1995 through 2001, mostly in California.

The company said, “the construction defect claims represent building contractors’ loss exposures from reinsurance programs that were underwritten by Folksamerica during the 1995 through 2001 underwriting years, primarily from California or a neighboring state. The adverse development was recognized following the receipt of significantly late reported claims.”

3) Tangible book value decreased slightly quarter over quarter and is at $443. This is up 9% from March 31, 2007.

WTM has an annual investor meeting every June in New York City, and investors can listen in on the WTM web site:

White Mountains Insurance

Posted by

TJF

at

9:14 PM

0

comments

![]()

Labels: White Mountains Insurance, WTM

Berkshire Meeting Recap - Things You Didn't Read in the Mainstream Media

Here are some good quotes from the Berkshire meeting in Omaha that took place last weekend. Most of these were not reported in the mainstream media as they seemed to focus on his "think small" comment regarding returns. I did not attend the meeting, but culled these quotes from the notes taken by Shai Dardashti, and posted on Seeking Alpha. They are not exact quotes since no recording equipment is allowed during the question and answer period.

1) Question - How to pick great managers?

I can’t be of help if you are looking at group of MBAs. They know at this point in life how to fool you, what answers to give you.

My Commentary - Damn right, when I was in grad school, we spent a lot of time learning how to lie during interviews.

2) Question - A University of Chicago Graduate student asked me once, what are we being taught that is wrong?

In business school the amount of time spent teaching option pricing is total nonsense. You only need 2 courses, how to value a business and how to think about stock market fluctuations.

My Commentary - One could make the same claim about the CFA program as well.

3) Question - Big positions. How do you get confident enough?

Students learn corporate finance at business schools. They are taught that the whole secret is diversification. But the exact rule is the opposite. The ‘know-nothing’ investor should practice diversification. Diversify– but it is crazy if you are an expert. If you only put 20% in the opportunity of a lifetime – you are a not being rational. Very seldom do we get to buy as much of any good idea as we would like to.

4) Question - Are investment banks too complicated? Risks unknown?

I think Fed did right thing with Bear. They would have failed on Sunday night, and walked to a bankruptcy judge. They had 14.5tril of derivative contracts – not as bad as it sounds, but the parties that had those contracts would have been required to undo the contracts to establish the liability from the estate.

My Commentary - Surprising answer given his reputation for being unforgiving to people who take too much risk.

5) Question - Do you believe in Jesus Christ?

Buffett - I am an agnostic.

Munger - I don’t want to talk about my relationships.

Buffett - Being an agnostic I don’t have to have an opinion.

My Commentary - Certainly the most surprising question of the day.

6) Question - How do we better measure leverage and accounting of assets, integrity?

Munger - A lot goes on in bowels of American industry which is not pretty. A lot of people got overdosed on Ayn Rand. They would hold that even if an axe murderer in a free market is a wise development. I think Alan Greenspan did a good job on average, but he overdosed on Ayn Rand that whatever happens in free market is going to be alright. We should prohibit some things. If we had banned the phrase, “this is a financial innovation which will diversify risk”, we would have been far better off.

Buffett - When you get into CDO squared, the documentation is enormous. If you read a standard residential security – it consists of thousands of mortgages, then different tranches. Then take CDO and take junior tranches on a whole bunch of juniors – put them together and diversified in theory – a big error to start with. That was nuttiness squared. You had to read 15,000 pages to get a CDO, then 750k pages to evaluate one security in a CDO squared. To let people use 100cents they paid vs. the 10cents it trades at in market is an abomination.

Posted by

TJF

at

2:40 PM

0

comments

![]()

Labels: Berkshire Hathaway, Warren Buffett

Friday, May 2, 2008

The Unknown Stock Report

I have decided to start up a paid investment newsletter focusing on individual stocks. I know the landscape is very crowded for such an endeavor, but I will truly strive to be unique and useful to my subscribers. The newsletter will focus on only one stock per issue, with an occasional update on previous stocks that have appeared. I have decided to call it "The Unknown Stock Report." I know the name sounds corny but it’s all I could think of.

What Do I Mean by an Unknown Stock?

Well, to put it simply, and at the risk of sounding a little bit like a wise ass, it's a stock that no one has heard of. There are tens of thousands of publicly traded domestic companies in the United States, yet maybe less than a thousand or so have analyst coverage. An even smaller subset of these stocks that have analyst coverage ever appear in the mainstream media in any substantial way. Most investors stampede into the same old stocks because it makes them feel warm and cuddly inside. This does not mean that these are the best stocks to own, as we all know.

Why Focus on Unknown Stocks?

I am a Value Investor, and a Value Investor is by nature a contrarian and the stocks described above tend to be underowned and therefore by definition undervalued relative to peers who trade in a more liquid and noticeable fashion.

So How Are We Different?

First, we have a strict policy of not accepting any compensation from any company that we write about. This includes compensation in the form of cash or warrants. You would be surprised just how many newsletters have buried in its disclosure statement, in as small a font as humanly possible, a small blurb about how much money the company paid to get a report written about them. We don't do that. In fact, I would open my throat with a knife before I took money from a company I am writing about. I am not a shill.

Second, I will also disclose any ownership stake that I have and at what price I paid for the shares. I put my money where my mouth is. I am also doing this for legal reasons, since I manage an investment partnership.

Third, any stock I write about will be a stock that I want you to buy. There will be no obtuse ratings system consisting of numbers from 1 to 5, or my favorite - accumulate.

Fourth, I won't insult your intelligence by telling you that you will become a millionaire by subscribing to my monthly newsletter, but I will guarantee that every month you will learn something about a new stock.

Why Am I Charging You For This?

I know what you are thinking - how dare I charge you for this, don't I know how much stuff is out there for free? Well, I enjoy writing in my other two blogs, and I appreciate the occasional "click" on my google ads, but at the end of the day, my family and I need to eat. I have four kids, with one entering college in the Fall. I think that $149 a year for 12 monthly issues is reasonable. So click on this link:

The Unknown Stock Report

and then click on the subscribe button at the top left of the page above and go to Pay Pal. I will publish the first issue in June. If you are truly dissatisfied after reading the first issue, I will refund your money.

Posted by

TJF

at

7:32 AM

0

comments

![]()

Labels: Unknown Stock Report, Value Investing, Value Stocks

Thursday, May 1, 2008

A Look Inside The Housing Crisis

The Cleveland Federal Reserve just posted a series of maps on its web site detailing the impact of the Housing Crisis on Cleveland, which is one of the hardest hit cities out there.

Chart 1 shows that an astounding number of loans are in REO status. Three zip codes encompassing East Cleveland, Cleveland and Cuyahoga Heights have anywhere from 3.3% to 8% of loans in this status. I guess the Cleveland Fed couldn't find a color darker than red to give us more granularity than that.

Map 2 shows the number of homes in foreclosure:

Again the same zip codes and up to 15% in foreclosure or bankruptcy.

The last map shows the number of speculators in the market:

Anywhere from 27-40% of the homes in these zip codes are owned by speculators.

The scary thing is that this data is as of January, so it is probably worse than the charts show.

You can look at the original publications here at the Cleveland Fed.

Posted by

TJF

at

11:11 AM

1 comments

![]()

Labels: Cleveland, Federal Reserve, Foreclosures, Housing, OREO