White Mountains Insurance (WTM) held its annual analyst meeting on June 17, and I finally got around to listening to the webcast. The URL is here if you want to listen yourself.

I have written five other posts on the meeting. They are:

WTM - Introductory Comments

WTM - The Reserve Issue

WTM - Review of One Beacon

WTM - Review of White Mountains Re

WTM - Review of Esurance

WTM Investments

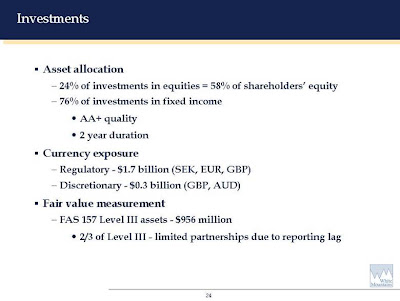

The next topic that WTM discussed was the investment area and the results that the company earned on its investment portfolio.

The company earned 0.8% on its portfolio in the first quarter of 2008. This was a decent performance considering that the main index was down 9.4%. The five-year return on its portfolio is 6.9%.

Fixed Income comments: “avoided losses…stayed out of the sub prime market and the alphabet soup of CDO’s and others…. high quality low duration portfolio.”

Equity comments: “security selection again…slanted toward Energy and Utilities…examining every security to avoid problems.”

Asset allocation - WTM has 24% of its portfolio in equities, and 76% in fixed income.

WTM discussed next the Level III assets in its portfolio. The company has Level 3 assets of $ 956 million and said that 2/3rds of the assets are partnerships and are there due to technical issues. The partnerships report on a one-month lag basis so they have to go in the Level III category. The company insists that they don’t have any “funny assets” in the Level III category and that most are long short equity partnerships (hedge funds).

Investment Outlook

Fixed Income - in a low interest rate environment so few chance of high returns here – pockets of opportunity – spreads have gapped out here last year due to credit crisis but those won’t pay off until 2009 due to volatility of market.

Equities – better risk reward here – believe they will pay off in three years – stick to your knitting – keep risks low - Don’t chase return – stay out of trouble – buy Value stocks.

My Comments

The investment returns are obviously very important to an insurance company and WTM has done well here considering the market environment. The second quarter return for the portfolio was later reported at 0.4%. I think the market is still worried about the amount of Level III assets since not much is disclosed on its composition. Although the management at WTM says that they are mostly Value oriented private partnerships, the definition of “Value” is wide enough to drive a truck through, and many similar funds have not had good years. Barrette did say later on that most were not leveraged so the main risk was “pilot error.”

Tuesday, August 26, 2008

White Mountains Insurance (WTM) Analyst Day - Investment Portfolio

Posted by

TJF

at

2:13 PM

1 comments

![]()

Labels: Property and Casualty Insurance, White Mountains Insurance, WTM, WTM Analyst Day 2008

Monday, August 25, 2008

White Mountains Insurance (WTM) Analyst Day - Review of Esurance

White Mountains Insurance (WTM) held its annual analyst meeting on June 17, and I finally got around to listening to the webcast. The URL is here if you want to listen yourself.

I have written four other posts on the meeting. They are:

WTM - Introductory Comments

WTM - The Reserve Issue

WTM - Review of One Beacon

WTM - Review of White Mountains Re

Review of Esurance

Gary Tolman, President and Chief Executive Officer of Esurance led off with the same opening slide as the other segments with a notable exception – the slide omitted net written premiums and used direct written premiums, and instead of combined ratio, it had policies in force.

I suppose this should be expected since the company is focused on growth, and its combined ratio is significantly over 100%. The company says this is because of arcane accounting rules, which require the company to amortize expenses over an arbitrary short time frame instead of the life of the policy. Since the company is a direct writer of business, it must amortize its acquisition expenses over six months. It adjusts this by reporting both a GAAP combined ratio and what they call an economic combined ratio. After this adjustment, the combined ratio drops from 116% to 104%.

Tolman reviewed Esurance for the audience:

- Personal auto insurer

- Company writes non-standard insurance but not the bottom of the barrel risk.

- 70% of business is acquired online.

- Focus is on the younger market with an average age of 35, with about 40% in the 20’s.

- Underwrites in 28 states – entering this year into UT and OK – 85% of market covered.

Tolman then discussed Answer Financial, an online agency that WTM owns 69% of. (WTM bought the balance of the company in July 2008)

Answer Financial is an agency that writes business in all 50 states, offering quotes from 15 different auto insurers. The company earned $40 million in commission on $350 million in premium volume.

Esurance has an 8% conversion rate on quote requests because many of the requests are for coverage in states that it doesn’t write in. It can now send this business to Answer Financial. WTM is already 30% of its business. They also have $300 million in net operating losses (NOL) that can be monetized.

My Comments

Esurance has always been a controversial asset for WTM, and many investors don’t like the idea of writing non-standard auto insurance. This paranoia was stoked recently by an adverse reserve development last year of $30 million for the years 2005-2006. Loss ratios were also up by 3 points. The adjustment from GAAP to economic combined ratio does not wash with some value investors who view any adjustment to numbers as heresy, second only to high treason.

Answer Financial seems like a decent company, but my concern is that once is becomes part of the WTM family, will the other 14 auto insurers who sell through Answer Financial take business to another agency since Esurance is its competitor. Also, because Answer Financial has no hard assets, the purchase price that WTM paid is being assigned mostly to Goodwill on the balance sheet. Goodwill is another heretical term in the Value investing community, which has typically been the investor base of WTM. The appearance of goodwill is also leading to WTM reporting an adjusted book value every quarter. I will discuss this change in a future post.

Posted by

TJF

at

6:55 AM

0

comments

![]()

Labels: Property and Casualty Insurance, White Mountains Insurance, WTM, WTM Analyst Day 2008

Friday, August 22, 2008

Third Avenue Value Fund Letter

I just read through the third quarter shareholder letter from Marty Whitman at the Third Avenue Value Fund. Some tidbits from the letter:

1) The fund was hit with $500 million in redemptions in the quarter, and had to sell "non-core" positions. Cash in the fund is now at $719 million or 8.5% of assets.

2) During the quarter Whitman bought $1.5 million of the fund, bringing the total that he controls through his wife and others to 1.5 million shares. At the August 11 net asset value of $49.56, his stake is worth approximately $75 million, so he certainly has skin in the game. One of his senior analysts bought $200,000 of the fund also.

3) New position in Sycamore (SCMR) of 10 million shares. Increased position in ABK and MBI.

4) Eliminated the fund's position in White Mountains Insurance (WTM). He explained in the letter - "None of the securities sales during the quarter were made for investment reasons; they were all made for portfolio reasons, so that the Fund could maintain an adequate cash cushion."

He defended his position in MBIA Insurance:

"it is theoretically possible that claims experienced over the next few years could be so bad that there would be little or no value for the common stocks of monoline insurers and mortgage insurers. To date, there is no credible evidence that this might be the case. A wipe-out of the equity seems remote."

Third Quarter Letter

Posted by

TJF

at

12:57 PM

1 comments

![]()

Labels: Marty Whitman, Third Avenue Value Fund

White Mountains Insurance (WTM) Analyst Day - Review of WTM Re

White Mountains Insurance (WTM) held its annual analyst meeting on June 17, and I finally got around to listening to the webcast. The URL is here if you want to listen yourself.

I have written three other posts on the meeting. They are:

WTM - Introductory Comments

WTM - The Reserve Issue

WTM - Review of One Beacon

Review of White Mountains Re

The next business segment to present was White Mountains Re. WTM already covered the reserve issues here at the start of the analyst meeting so it spent most of the time discussing other issues. They first presented net written premiums and combined ratios for the last five years.

The results show exactly what an investor wants to see at an insurance company. A declining combined ratio, with strong net premiums written growth, but the growth tailing off as the soft market starts and the company refuses to write unprofitable business. Management seemed to confirm this also. “We showed a little bit of growth in the hard market from 2004-2006 but now you see our premiums coming down and from 2006 where we wrote $1.3 billion we’ve now declined to $1.1 billion which is about a 15% decline. That’s the front edge of our soft market strategy.”

Management reiterated this philosophy later on in the presentation. “We are not going to write under priced business and we are not very focused on the top line. We are really focused on your bottom line and if we need to get smaller to maintain our returns we are going to do that and we’ll return the capital we are not using to WTM and it will be put to good use elsewhere. Most of the shrink (in premiums) is coming from the North American market where prices are declining more rapidly than Europe and elsewhere. The European market tends to be more stable.”

WTM Re is unofficially projecting a combined ratio less than 100% for the full year 2008, and explained. “We had a fairly calm first half of the year so far and if we include a full catastrophe load in second half results which is the long term average catastrophe experience…we can report a combined ratio of less than 100% for the year.”

Management covered the three segments under the WTM Re Organization – WTM Re America, WTM Re Sirius and WTM Re Bermuda.

WTM Re America

This unit has $900 million in regulatory capital and writes business in the excess and surplus market, property casualty, accident and health, and agricultural market. Management said that the casualty market is the one line coming down the most. “The casualty business is the one that is actually shrinking probably most rapidly. That was a $350 million business in the hard market and it is heading down to just north of a $100 million business next year.”

Also in this business unit is WTM Re Solutions, which is located in Simsbury, CT. They specialize in acquiring broken insurance and reinsurance properties that are mostly in run off situations. They have closed five deals since 2001 and have generated total expected profits in excess of $150 million.

WTM Re Sirius

This appears to be the crown jewel of the entire company. Sirius is a European based company that was bought by WTM in 2004 for $427.5 million, which was less than book value, and it now produces $125-150 million in earnings. Ray Barrette said earlier in the presentation that Sirius has a safety reserve that exceeds the total price that WTM paid for it.

The management at WTM Re explained the safety reserve:

“Sirius has in its U.S GAAP books a $400 million deferred tax liability. We don’t ever expect to pay that deferred tax liability not a penny of it. The Swedish regulators don’t require recordation of that liability in fact they count that money as capital. And the ratings agencies count that money as capital. But it’s not in our GAAP net worth but when we look at Sirius business however we think of that as quasi equity that’s really a cheap source of leverage in that business.”

The 10-K explains it in more formal terms:

“In accordance with provisions of Swedish law, Sirius International is permitted to transfer up to the full amount of its pre-tax income, subject to certain limitations, into an untaxed reserve referred to as a safety reserve, which equaled $1.4 billion at December 31, 2007. Under GAAP, an amount equal to the safety reserve, net of the related deferred tax liability established at the Swedish tax rate of 28%, is classified as shareholder's equity. Generally, this deferred tax liability is only required to be paid by Sirius International if it fails to maintain predetermined levels of premium writings and loss reserves in future years. As a result of the indefinite deferral of these taxes, Swedish regulatory authorities do not apply any taxes to the safety reserve when calculating solvency capital under Swedish insurance regulations. Accordingly, under local statutory requirements, an amount equal to the deferred tax liability on Sirius International's safety reserve ($398 million at December 31, 2007) is included in solvency capital. Access to the safety reserve is restricted to coverage of aggregate losses and requires the approval of Swedish regulatory authorities.”

WTM Re Bermuda

This is the newest operating affiliate of WTM Re and it has been capitalized with $776 million at the end of 2007. It began writing business in the second quarter of 2008.

WTM Re Outlook

Premium will shrink to $ 1.1 billion in 2008, down 13% roughly from 2007, as the company maintains underwriting discipline. WTM Re will become a smaller more profitable company with lots of capital to pursue opportunities during the upcoming soft market.

Management added this at the end regarding increased competition coming into the market. The comments require further investigation:

“We’ve got players coming in from all over the place into our business whether they are hedge funds or private equity using all different types of securities CAT bonds, sidecars. We have used a couple of sidecars in the past ourselves. Many of these sources of capital have a lower cost of capital for the risk they are taking on than we do on our own balance sheet.”

“That’s a tough equation to win and rather than trying to compete with that in our present format we will have to become more and more competitive in those market sand use those tools.”

“So over time I would expect and this will be gradual that WTM RE will become more of a service company and less of a risk bearing entity and that will produce better and less risky returns and free up more of our capital for use at WTM.”

Posted by

TJF

at

11:40 AM

0

comments

![]()

Labels: Property and Casualty Insurance, White Mountains Insurance, WTM, WTM Analyst Day 2008

Friday, August 15, 2008

Regional Economic Outlook

The Dallas Fed just released its August 2008 regional economic outlook. It looks like even the booming Energy industry isn't enough to stop the spread of the economic slowdown.

The Texas economy slows to its lowest growth rate since 2003.

Employment growth also slows down - not negative yet like the overall U.S.

Housing prices held up much better than the rest of the U.S. but are starting to roll over.

Posted by

TJF

at

9:19 AM

0

comments

![]()

Labels: Dallas Fed, Energy, Federal Reserve

Thursday, August 14, 2008

The FDIC Realty Company

The Federal Deposit Insurance Corporation (FDIC) has already shut down 8 banks this year:

First Priority Bank, Bradenton, FL - August 1, 2008

First Heritage Bank, NA, Newport Beach, CA - July 25, 2008

First National Bank of Nevada, Reno, NV - July 25, 2008

IndyMac Bank, Pasadena, CA - July 11, 2008

First Integrity Bank, NA, Staples, MN - May 30, 2008

ANB Financial, NA, Bentonville, AR - May 9, 2008

Hume Bank, Hume, MO - March 7, 2008

Douglass National Bank, Kansas City, MO - January 25, 2008

As part of the process of closing these institutions and finding stronger banks to take them over, the FDIC becomes receiver for some of the assets of these banks. The deposits and performing loans go to the stronger bank, but it seems that it is up to the FDIC to get rid of the non performing loans and other real estate owned (OREO) of these institutions.

The listing are on the FDIC web site.

If you search under FDIC Real Estate for Sale, you will find that the FDIC owns 68 properties ranging from dilapidated housing selling for $4,900 in Flint, Michigan; all the way to a mansion in the Detroit suburb of Grosse Pointe Farms selling for $1.2 million.

View Larger Map

The FDIC is also the proud owner of about 100 unfinished or partially finished lots courtesy of ANB Financial, the Arkansas bank it closed in May. It is selling these in a Special Real Estate Sales Event on August 29.

It also owns another three pages of houses that it took from ANB Financial.

Last, if you really want to roll the dice, you can buy a portfolio of $145 million in performing and nonperforming commercial, residential and consumer loans.

There are sure to be some great bargains on this site as the FDIC inventory grows.

Posted by

TJF

at

5:10 PM

0

comments

![]()

Four Things I Hate on Wall Street

There are many things I hate on Wall Street. Here is a list of four of them. Why do you care about this list? Well you don't necessarily, but it is my blog and if I want to post a list of things that I hate on Wall Street, then I will. If you don't want to read it, then don't.

Fed Watching - I spend a considerably amount of time hating talking heads on CNBC and Bloomberg espousing on the intentions of the Federal Reserve and its esteemed Chairman. Will they ease? Will they cut? Are they pausing?

The truth is, who cares what the Fed does? If you can find a stock worth $10 a share selling for $8 a share, then the Fed chairman could stick his head up his ass and it won't matter one bit. If you are a day trader, then I suppose you should care, but since I am not, I don't. A case can also be made that the financial media perpetuates and reinforces deviant behavior in investing by devoting too much air time to these events.

Smart Money - There is an enduring myth on Wall Street about "smart money." The term is a little condescending as it implies that everyone else is not "smart money" but therefore is "dumb money." The myth is that somehow, once an investor gets enough publicity and name recognition, and then has a decent track record, then somehow that investor has some sort of mystical power to select stocks that will outperform. Just think of a herd of investors, and the "smart money" is a cow in that herd that stands out from the rest and once he or she moos, everyone follows them.

So I don't actually hate investors that are "smart money," since most of them I have never met, and probably never will. What I hate is the concept, and the concomitant and Pavlovian response of other investors who blindly follow these people around without doing their own research or work. (Wow, did I really just use the word concomitant in a sentence?)

Catalyst Investors - I hear many investors talk on TV about a stock and how much they like it, etc. But then they say something like this - "I really like the stock, but I just don't see a catalyst for the stock going forward." What does this really mean?

A catalyst is defined in science as "a substance that speeds up a chemical reaction without itself undergoing any permanent chemical change." For our purposes it is a "thing that causes an important change to take place." Well don't you get it, you jackass, if you were a Value Investor, you wouldn't need a catalyst. Your "catalyst" in fact, is the rest of the market finally realizing that the stock is undervalued relative to its assets or earnings power.

The Market - There are many investors who use the market as a crutch or to defend their beliefs and/or stock picks. They will say "Well, that's what the market thinks, or that's what the market is saying." The problem with this, of course, is that the market is dominated by short term irrational investors who herd en masse into stocks and chase performance. This also creates and perpetuates investment bubbles. The fact that the market supports what you happen to be saying at that moment is not an investment thesis.

Posted by

TJF

at

6:50 AM

0

comments

![]()

Labels: Catalyst Investing, Federal Reserve, Smart Money, Wall Street

Tuesday, August 12, 2008

The Fed and Blogging

The Atlanta Federal Reserve started blogging today - well sort of. They are actually restarting the Atlanta Fed blog as macroblog, which was the blog of David E. Altig, the Senior Vice President and Director of Research at the Atlanta Fed. His blog has been on hiatus since he joined the Fed in August 2007.

The blog is located here.

Posted by

TJF

at

1:39 PM

0

comments

![]()

Labels: Federal Reserve

Monday, August 11, 2008

Wall Street Mea Culpa

The Counterparty Risk Management Policy Group III (CRMPG III) released its report last week called, "Containing Systemic Risk: The Road to Reform."

The group was formed by the private sector to "focus its primary attention on the steps that must be taken by the private sector to reduce the frequency and/or severity of future financial shocks."

This has been billed as the "What Went Wrong," report by pundits and bloggers. It was a lengthy report and I don't think I will have time to read the entire thing, but I did a word search and couldn't find any of these words in the document:

Greed, Dishonesty, Avarice, Self Interest, Gluttony, Duplicity, Voracity, Ravenousness, Conflict of Interest or Double Dealing.

or any of these phrases:

"Too smart for their own good."

"Can't see the forest for the trees."

Posted by

TJF

at

8:49 AM

0

comments

![]()

Labels: CRMPG

Friday, August 8, 2008

White Mountains Insurance (WTM) Analyst Day - Review of OneBeacon

White Mountains Insurance (WTM) held its annual analyst meeting on June 17, and I finally got around to listening to the webcast. The URL is here if you want to listen yourself. I have written two previous posts on the meeting:

Reserve Issue and Barrette Speaks.

OneBeacon Presentation

OneBeacon (OB) is a publicly traded company that is 75.1% owned by WTM. Mike Miller, the President and Chief Executive Officer of OneBeacon, said that since the partial IPO in November 2004, book value for the company has grown by 22%. The book value in the first quarter of 2008 was down 1% due to a flat investment return. The combined ratio in the quarter was 100%, which was good considering that the first quarter is typically its most challenging.

Book value growth in 2008 will not reach the 17% growth achieved in 2007, due to a “softening insurance marketplace…well as a choppy investment climate.”

Miller showed a chart of net written premiums and the combined ratio for OneBeacon for the last five years, showing a decline in net written premiums from $2.4 billion to $1.8 billion from 2004 to 2007. The combined ratio also declined from 99% to 93% over the same time period.![]()

Miller says this was the result of a repositioning of the company and the book to one that was more specialized in focus, and “a significant amount of effort went into making sure that our $2 billion book of business roughly that we have is a book of business that we believe in that we understand general line dynamics and results in.”

OneBeacon, which focuses on specialty commercial lines, started seven new business segments since 2005, and has a personal lines business in eight Northeastern states. “We don’t have a nationwide personal lines business; we are focused in New England region. It’s a book of business that we’ve had since the inception of OneBeacon in 2001. It’s a book of business we know, we understand, the agents know who we are.”

Miller indicated that any expansion from this region was unlikely. “To consider going nationwide with a personal lines business we would bring little to distinguish ourselves and would not be a good use of your capital.”

Miller also said that the personal lines business has become more “challenged” and competitive the last year and a half, but that OneBeacon has been “holding our own in the Northeast and more importantly we have a consistent level of profitability in that Northeastern book of business.”

OneBeacon has tried to manage capital well and paid a special dividend of $190 million in the first quarter of 2008, and has repurchased 4% of the outstanding shares of the company over the last year.

My Comments:

It’s always been amazing to me how every insurance company proclaims as loudly as possible that they won’t write unprofitable business during a soft market, yet somehow the industry collectively does write it. Also, OneBeacon is performing a review of its reserves and balance sheet in the third quarter, and let’s hope that they don’t find any reserve skeletons in its closet like White Mountains Re did.

Posted by

TJF

at

10:10 AM

0

comments

![]()

Labels: Insurance, Property and Casualty Insurance, White Mountains Insurance, WTM Analyst Day 2008

Wednesday, August 6, 2008

White Mountains Insurance (WTM) Analyst Day - Introductory Comments

White Mountains Insurance (WTM) held its annual analyst meeting on June 17, and I finally got around to listening to the webcast. The URL is here if you want to listen yourself.

I wrote a post on the Reserve Issue at WTM, and this is a summary of the balance of Ray Barrette's introductory comments.

Introductory Remarks

After discussing the reserve issue at WTM Re, Barrette talked about undeployed capital at WTM and the plans for its use. He then used that as a vehicle to launch into a defense of the Berkshire transaction (buying Berkshire’s share of WTM). WTM is buying back 1/6 of the outstanding shares of WTM from Berkshire Hathaway. They believe that this is a prudent use of its capital.

Barrette said, “so $485 was the price and we hit the bid and I think when you look back five years from now or ten years from now, whether it was $485 or $450 it will have been a good deal for the company...We think the deal will close in the third quarter and we are happy with it.”

Barrette then hinted that share buybacks would restart if the price continued to stay down in the mid $400 range. “We also bought back some shares at $500 average last year, 291,00 we still have 700,000 shares as a buyback program, its not a program it is an allowance from the board, we still have excess capital but we are entering Cat (catastrophe) season so we have to be a little bit more careful about being too thin during the Cat season but as our businesses shrinks in the soft market as we produce I believe good underwriting results, good investment results we will generate more undeployed capital as we go forward here so at this price I can tell you we are buyers of our shares.”

Barrette next talked about the purchase of Answer Financial (AF), an online insurance agency. WTM spent $30 million to buy 69% of AF, and it will be used to help Esurance convert more of its incoming rate inquiries into business. The current conversion rate is 8% and WTM's goal is to double that rate. AF also has large net operating losses (NOL’s) that can be used.

Barrette said, "“It’s a good financial deal. We paid a discount to what we think is the real solid value of the company but that value is not a book value it is not an insurance company, it is an agency. We are buying intangibles so for the first time in a long time you will see us put up some intangibles and some goodwill to our balance sheet but we tell you we have a very good deal but the numbers are not huge.”

My Comments

Barrette made a spirited defense of the purchase of Berkshire Hathaway's stake in WTM. The price on the day of the analyst meeting was $442, which was 10% below the $485 paid to Berkshire, so maybe he was getting some heat from shareholders. Later during the analyst meeting, management went into further detail on the transaction. WTM also bought the balance of Answer Financial in July, and now owns 100%.

Posted by

TJF

at

10:10 AM

1 comments

![]()

Labels: Insurance, Property and Casualty Insurance, White Mountains Insurance, WTM, WTM Analyst Day 2008

Monday, August 4, 2008

White Mountains Insurance (WTM) Analyst Day - The Reserve Issue

White Mountains Insurance (WTM) held its annual analyst meeting on June 17, and I finally got around to listening to the webcast. The URL is here if you want to listen yourself.

I have twenty-eight pages of notes so I will have to present this in more than one post. I’ll start with the surprise reserve addition that was announced at the meeting.

White Mountains Re Reserve Issue

After brief introductory remarks by Ray Barrette, WTM spent the first 15 minutes coming clean on the reserve problems in its Folksamerica unit, now called White Mountains Re America.

WTM is increasing reserves at this unit by $140 million in the second quarter of 2008. This will be partially offset by an $80 million reserve release at its Sirius unit, giving the company a net increase of $60 million in reserves. The after tax number is $ 33 million. The timeline of events that led to this is as follows:

1) WTM added $63 million to reserves in the fourth quarter of 2007.

2) In Feb 2008, WTM begins an intensive review of the reserves and underwriting books at the company.

3) In May 2008, WTM increased reserves by $41 million for late reported construction defect claims at Folksamerica for underwriting years 2002 and prior.

4) At the July analyst meeting, WTM announced the additional reserve issues in the first paragraph above.

Barrette went out of his way to emphasize that he felt they had cleaned house at this unit and that the reserve issue was now behind them, and even seemed to imply that there was a chance of a reserve release in the future.

He said, “But I have to say before we have never done the work that we did this time to get to the bottom of this…we did a deep dive, we think we have it. It’s still the Property casualty reinsurance business so there is no guarantee that there aren’t going to be some reserve development somewhere but we think we have reserves so that it is as likely that something good can happen to the reserves as bad…”

Allan L. Waters, the President and CEO of White Mountains Re, drilled down a little deeper on the issue:

1) In the first quarter of 2008, WTM received two claims activity reports for business written in 2000 and 2001 relating to California Construction defects. They did a quick review and found two other accounts with exposure, and took the $41 million reserve increase ($29 million) after tax.

2) WTM was a little concerned by this so they did a complete review of the books, which resulted in the $160 million gross reserve addition, all from business written during the last soft market from 1996-2002.

3) They confirmed that they felt that business since 2002 has been properly underwritten due to changes that WTM made at the time in underwriting and controls.

4) The net after tax reserve addition of $33 million announced at the analyst meeting represents 2% of group reserve base, 1% of regulatory capital and 1% of shareholders equity.

Waters said, ““We really worked hard to get to the bottom of this we dug as deep as we could and felt that we hit bedrock here. There is no guarantees in this business here. This is the property casualty business, the property casualty reinsurance business which is even worse in terms of trying to predict your future reserves but we think we have gotten to the bottom of this and booked everything we found and we put this behind us once and for all.”

Posted by

TJF

at

7:43 AM

0

comments

![]()

Labels: Property and Casualty Insurance, White Mountains Insurance, WTM, WTM Analyst Day 2008

Saturday, August 2, 2008

Quote of the Day - Centex Corp. (CTX)

Quote of the day comes from the Centex Corp. (CTX) conference call that was held on July 30, 2008.

"Conditions in the housing market worsened in the quarter and we don't see any improvements in market conditions for remainder of this fiscal year. Foreclosures are arising dramatically in most markets, employment growth is slowing. Mortgage rates are on the rise and we're seeing stricter mortgage qualification requirements for home buyers. Energy costs have increased substantially for our subcontractors, suppliers and customers."

Timothy Eller - Chairman and Chief Executive Officer of Centex Corp.

Posted by

TJF

at

7:08 AM

4

comments

![]()

Labels: Centex, CTX, Homebuilders, Housing