Americans are still driving less, despite the fall in gas prices. The latest report through the end of September shows a 4.4% decline in miles driven, year over year. This equates to 10.7 billion less miles. This trend in driving less began last year and as can be seen in the chart below, is unprecedented in the last 25 years.

Tuesday, November 25, 2008

Travel Trends - September 2008

Posted by

TJF

at

8:21 AM

0

comments

![]()

Labels: Travel Trends

Monday, November 24, 2008

A Bloodbath Out There

I did a screen in Finviz, a great site that you should check out if you don't know about it, and only 11 stocks out of the S & P 500 are up year to date through the close on November 21. They are:

Family Dollar Stores (FDO)- Up 34.21%

Rohm and Haas (ROH)- 34.18%

UST Inc (UST)- 29.8%

Barr Pharmaceuticals (BRL)- 21.62%

Amgen (AMGN)- 18.22%

General Mills (GIS)- 16.62%

Walmart (WMT)- 12.79%

Hudson City Bancorp (HCBK)- 12.01%

Campbell Soup (CPB)- 3.48%

Celgene (CLGN) - 2.79%

People's United Financial (PBCT) - 1.63%

Surprisingly, two banks are on the list. There are three biotech/pharm companies, and a few staples. Rohm and Haas is being bought by Dow Chemical, which explains its resilient performance. UST is also being purchased by Altria.

Hudson City Bancorp turned down the government investment via the Capital Purchase Plan, and People's United Financial just replaced Unisys two weeks ago.

Posted by

TJF

at

6:49 AM

0

comments

![]()

Labels: Stocks

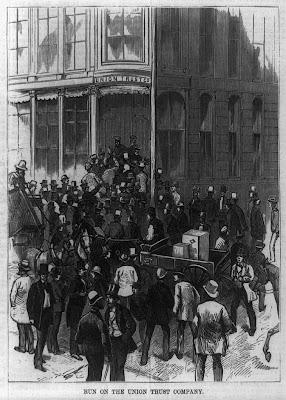

Will This Be Citibank on Monday Morning?

An engraving from the run on the Union Trust Company during the Panic of 1873.

Will This Be Citibank on Monday Morning? No, it won't but the market seems just as scared nonetheless.

Posted by

TJF

at

6:14 AM

0

comments

![]()

Labels: Banks

Saturday, November 22, 2008

FDIC Triple Header - The Community Bank of Loganville, Georgia

The third bank closed by the FDIC yesterday. From the press release of the FDIC:

"The Community Bank, Loganville, Georgia, was closed today by the Georgia Department of Banking and Finance, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Bank of Essex, to assume all of the deposits of The Community Bank."

"The Community Bank's four branches will open on Monday, November 24, 2008 as Bank of Essex. Depositors of the failed bank will automatically become depositors of Bank of Essex. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship to retain their deposit insurance coverage."

"The Community Bank had total assets of $681.0 million and total deposits of $611.4 million. Bank of Essex purchased approximately $84.4 million of The Community Bank's assets, and did pay the FDIC a premium of $3.2 million for the right to assume the failed bank's deposits. The FDIC will retain the remaining assets for later disposition."

"The transaction is the least costly resolution option, and the FDIC estimates that the cost to its Deposit Insurance Fund will be between $200 million and $240 million. The Community Bank is the twentieth FDIC-insured institution to be closed nationwide, and the third in Georgia, this year."

Posted by

TJF

at

7:22 AM

0

comments

![]()

Labels: Bank Failures, FDIC, Federal Deposit Insurance Corporation

FDIC Triple Header - Downey Savings and PFF Bank

The FDIC did a triple header Friday night with three banks going down. From the FDIC press release:

"U.S. Bank, National Association, Minneapolis, MN, acquired the banking operations, including all the deposits, of Downey Savings and Loan Association, F.A., Newport Beach, CA, and PFF Bank & Trust, Pomona, CA, in a transaction facilitated by the Federal Deposit Insurance Corporation."

"The combined 213 branches of the two organizations will reopen as branches of U.S. Bank under their normal business hours, including those with Saturday hours. Depositors will automatically become depositors of U.S. Bank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship to retain their deposit insurance coverage."

"Customers of both banks should continue to use their existing branches until U.S. Bank can fully integrate the deposit records of the organizations. Over the weekend, depositors can access their money by writing checks or using ATM or debit cards.

As of September 30, 2008, Downey Savings had total assets of $12.8 billion and total deposits of $9.7 billion. PFF Bank had total assets of $3.7 billion and total deposits of $2.4 billion. Besides assuming all the deposits from the two California banks, U.S. Bank will purchase virtually all their assets. The FDIC will retain any remaining assets for later disposition."

"The FDIC and U.S. Bank entered into a loss share transaction. U.S. Bank will assume the first $1.6 billion of losses on the asset pools covered under the loss share agreement, equal to the net asset position at close. The FDIC will then share in any further losses. Under the agreement, U.S. Bank will implement a loan modification program similar to the one the FDIC announced in August stemming from the failure of IndyMac Bank, F.S.B., Pasadena, CA."

Posted by

TJF

at

7:16 AM

1 comments

![]()

Labels: Bank Failures, FDIC

Thursday, November 13, 2008

Hedge Fund Kingpins Testify - Highlights

Here are some of the highlights from the prepared statements today in front of the House Committee on Oversight and Government Reform by the five famed Hedge Fund managers.

Phillip Falcone of Harbinger Capital Partners

"I would like to take just a moment to tell you a bit about myself. I currently reside in New York City with my wife of 11 years and two children. By way of background, I was born in Chisholm, Minnesota, population 5,000, on the Iron Range in Northern Minnesota. I was the youngest of nine kids who grew up in a three-bedroom home in a working class neighborhood. My father was a utility superintendent and never made more than $14,000 per year, while my mother worked in the local shirt factory. I take great pride in my upbringing, and it is important for the Committee and the public to know that not everyone who runs a hedge fund was born on 5th Avenue - that is the beauty of America."

More later.

Posted by

TJF

at

9:23 PM

3

comments

![]()

Labels: Hedge Fund

Sunday, November 9, 2008

FDIC Seizes Security Pacific Bank

Security Pacific Bank of Los Angeles, California was closed by the FDIC last Friday. The agency had a busy weekend as this was the second bank seized by the government on Friday. Pacific Western Bank assumed the deposits of the failed bank.

Final Stats (9/30/08):

Tier 1 leverage ratio - 3.14%

Tier 1 risk-based capital ratio - 3.71%

Total risk-based capital ratio - 5.00%

Noncurrent loans to loans - 19.94% at 6/30/2008.

News reports say that the bank was done in by loans to Homebuilders in the Inland Empire area of California.

Posted by

TJF

at

4:25 PM

0

comments

![]()

Labels: Bank Failures, FDIC

Franklin Bank, S.S.B., Houston, Texas Closed By The FDIC

Franklin Bank, S.S.B., Houston, Texas was closed by the FDIC on Friday.

Prosperity Bank of El Campo, Texas, assumed all of the deposits of Franklin Bank. Franklin Bank had total assets of $5.1 billion and total deposits of $3.7 billion. The bank was relatively new and was founded in 1987 as the Bowie State Bank.

It looks like Construction, land development, and other land loans did them in. The bank had $1.2 billion of these loans at 9/30/08, and $400 million were 30 days past due or in non accrual status.

Final stats on the failed bank:

Tier 1 leverage ratio - 2.11%

Tier 1 risk-based capital ratio - 3.37%

Total risk-based capital ratio - 5.11%

Noncurrent loans to loans - 11.06% (6/30/2008)

Capital ratios as of 9/30/2008.

Just to demonstrate how quickly capital can erode. The bank had a total risk-based capital ratio of 10.16% at 6/30/08.

Posted by

TJF

at

4:05 PM

0

comments

![]()

Labels: Bank Failures, FDIC

Tuesday, November 4, 2008

The Empire Strikes Back

On October 24, 2008, I posted on a paper from the Minneapolis Federal Reserve entitled "Facts and Myths about the Financial Crisis of 2008"

The paper listed what it called four myths that have arisen during the financial crisis:

1) Bank lending to non financial corporations and individuals has declined sharply.

2) Interbank lending is essentially nonexistent.

3) Commercial paper issuance by non financial corporations has declined sharply, and rates have risen to unprecedented levels.

4) Banks play a large role in channeling funds from savers to borrowers.

The Federal Reserve Bank of Boston has now counter punched with its working paper called "Looking Behind the Aggregates: A Reply to “Facts and Myths About the Financial crisis of 2008”

The conclusion:

"As Chari et al (2008) point out in a recent paper, aggregate trends are very hard to interpret. They examine four common claims about the impact of financial sector phenomena on the economy and conclude that all four claims are myths. We argue that to evaluate these popular claims, one needs to look at the underlying composition of financial aggregates. Our findings show that most of the commonly argued facts are indeed supported by disaggregated data."

Posted by

TJF

at

11:00 AM

0

comments

![]()

Labels: Federal Reserve, Financial Crisis

Monday, November 3, 2008

Things We Wish We Had Done Two Years Ago

From the press release of Corus Bankshares (CORS) last week:

“Corus did not originate any new loans in the third quarter of 2008. Given the uncertain condition of the commercial real estate market, and our desire to bolster our capital ratios, management has decided that this is not the right time to originate new loans. We hope that events will transpire over the coming quarters such that we will again feel comfortable originating loans.”

Corus is a major lender in South Florida for condos, where half its loans are non accrual or close to it.

Posted by

TJF

at

7:49 AM

0

comments

![]()

Labels: CORS, Corus Bankshares

Saturday, November 1, 2008

Bank Death Watch - Freedom Bank of Bradenton, Florida

The Freedom Bank of Bradenton, Florida failed last Friday. Its deposits were taken over by Fifth Third Bank. The bank was publicly traded on the OTC bulletin board under the symbol FBBF.

The bank started the year with $25 million in Equity capital, but by the end of the third quarter, capital was only $10 million. The capital ratios in the last call report (9/30/2008) were fairly gruesome:

Tier One Leverage - 2.0%.

Tier 1 risk-based capital ratio - 2.2%.

Total risk-based capital ratio - 3.45%.

The bank had $211 million in loans outstanding at 9/30/08, most of which were Real Estate loans.

Construction and Land Development - $176 million.

Commercial and Industrial - $32 million.

Noncurrent loans to loans - 15.49% (as of 6/30/2008)

In July, a private equity fund called Community Bank Investors of America LP, agreed to invest $5 million in the bank subject to it raising more capital elsewhere. I can't find any record of the fund completing the deal.

Posted by

TJF

at

5:38 PM

0

comments

![]()

Labels: Bank Failures, FDIC