White Mountains Insurance (WTM) held its annual analyst meeting on June 17, and I finally got around to listening to the webcast. The URL is here if you want to listen yourself.

I have written five other posts on the meeting. They are:

WTM - Introductory Comments

WTM - The Reserve Issue

WTM - Review of One Beacon

WTM - Review of White Mountains Re

WTM - Review of Esurance

WTM Investments

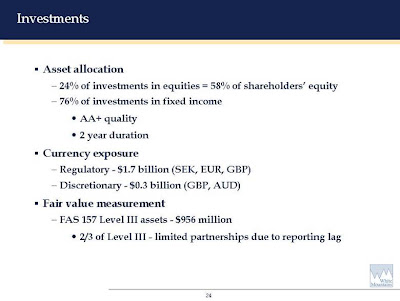

The next topic that WTM discussed was the investment area and the results that the company earned on its investment portfolio.

The company earned 0.8% on its portfolio in the first quarter of 2008. This was a decent performance considering that the main index was down 9.4%. The five-year return on its portfolio is 6.9%.

Fixed Income comments: “avoided losses…stayed out of the sub prime market and the alphabet soup of CDO’s and others…. high quality low duration portfolio.”

Equity comments: “security selection again…slanted toward Energy and Utilities…examining every security to avoid problems.”

Asset allocation - WTM has 24% of its portfolio in equities, and 76% in fixed income.

WTM discussed next the Level III assets in its portfolio. The company has Level 3 assets of $ 956 million and said that 2/3rds of the assets are partnerships and are there due to technical issues. The partnerships report on a one-month lag basis so they have to go in the Level III category. The company insists that they don’t have any “funny assets” in the Level III category and that most are long short equity partnerships (hedge funds).

Investment Outlook

Fixed Income - in a low interest rate environment so few chance of high returns here – pockets of opportunity – spreads have gapped out here last year due to credit crisis but those won’t pay off until 2009 due to volatility of market.

Equities – better risk reward here – believe they will pay off in three years – stick to your knitting – keep risks low - Don’t chase return – stay out of trouble – buy Value stocks.

My Comments

The investment returns are obviously very important to an insurance company and WTM has done well here considering the market environment. The second quarter return for the portfolio was later reported at 0.4%. I think the market is still worried about the amount of Level III assets since not much is disclosed on its composition. Although the management at WTM says that they are mostly Value oriented private partnerships, the definition of “Value” is wide enough to drive a truck through, and many similar funds have not had good years. Barrette did say later on that most were not leveraged so the main risk was “pilot error.”

Tuesday, August 26, 2008

White Mountains Insurance (WTM) Analyst Day - Investment Portfolio

Posted by

TJF

at

2:13 PM

![]()

Labels: Property and Casualty Insurance, White Mountains Insurance, WTM, WTM Analyst Day 2008

Subscribe to:

Post Comments (Atom)

1 comment:

Hi I liked your blog. I have been looking for a company which would specialize in servicing and sales of a diverse line of auto insurance products for quite a long time. I browsed the net for some useful info. And decided to go to Esurance. However, before going there I should have checked it out on this great site www.pissedconsumer.com to avoid possible misunderstandings. There people share their bitter experience with different companies.

Post a Comment