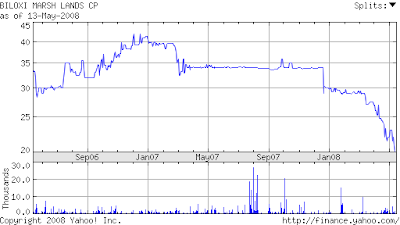

Biloxi Marsh Lands Company (BLMC.PK) is an intriguing company. I wrote a few posts on it last year, and it fell off my radar screen. It is currently selling at $20, which is a four year low. The company trades in the Pink Sheets but is a very transparent and open company, with regular SEC filings, a web site, and it makes efforts to reach out to the investment community.

BLMC.PK owns approximately 90,000 acres of wetlands in St. Bernard Parish, Louisiana. The land has no development potential but portions have been leased for mineral exploration since the 1930's. The company is transitioning from that of a royalty company to one with a more active role in exploration.

The company recently put detailed information on its website on two potential prospects on its land, at the NAPE EXPO in February 2008. Here is a link to the press release.

A summary of the two prospects, entitled "Alpha" and "Beta."

Prospect Area “Alpha”

1) 170 BCF of Natural Gas Reserve Potential

2)3D seismic Amplitude Anomalies including a classic “Gator-Mouth” Anomaly conforming to Structure

3) Multiple Fault Blocks covering +/- 1,500 acres

4) Average net sand thickness 150’

5) +/- 2,000 acres controlled

6) Multiple well development potential

Prospect Area “Beta”

1) 300 BCF of Natural Gas Reserve Potential

2) +/- 5,000 acre structure shown on 3D seismic

3) Documentation of sand and hydrocarbons present in original well

4) Original well failed upon flow test due to improper completion

5) Baker Hughes completion analysis indicates deeper perforations and gravel pack will aid in sand control

6) Average sand thickness 40’ net over +/- 5,000 acre structure

7) +/- 5,200 acres controlled

8) Multiple well development potential

BLMC.PK has no debt and $8.8 million in cash, $4.6 million in marketable debt and equity securities that are carried at cost, and $2.2 million in other investments. They paid a $1.00 dividend in 2007, the entire amount at year end.

I need to do some more research on this one before taking a position but it is interesting that the price has been cut in half while natural gas prices have been moving up.

Wednesday, May 14, 2008

Biloxi Marsh Lands Company (BLMC.PK)

Posted by

TJF

at

9:22 AM

1 comments

![]()

Labels: Biloxi Marsh Lands Company, BLMC, BLMC.PK

Tuesday, May 8, 2007

The CEO

The phone rings yesterday afternoon and it is Mr. Rudolf, the CEO and President from the Biloxi Marshlands Company (BLMC). Apparently someone had forwarded my blog post to him and he felt there were some misinterpretations on my part based on the reading of the press release from the first quarter earnings release. I didn't ask him who sent him the blog since I figured he would keep it confidential.

I made three points in my post. I will put the company's clarifications in italics.

1) Production was down year over year, and the reason given did not on the surface make sense.

BLMC reported the daily production as of the last day of the quarter, it is not an average daily production.

This explains why the reason given (well shut ins) did not make sense. I should have read the press release more carefully.

2) Delay in the start of the drilling package, and no explanation is given.

Manti was delayed drilling a previous well somewhere else and couldn't start the BLMC package on time.

This is believable as delays in drilling occur all the time.

3) The dividend was omitted this quarter.

The company has no set dividend policy according to Mr. Rudolf, so technically no dividend could be "omitted." The company decided that they would retain the earnings this quarter instead.

I'll let the market judge number 3.

I can tell by speaking to Mr. Rudolf that he has a great passion for the company, and I can't imagine BLMC being in better hands than a descendant of some of the original shareholders from the 1920's, and whose family still owns 8% of the stock.

Posted by

TJF

at

1:09 PM

3

comments

![]()

Monday, May 7, 2007

BLMC - Mr. Rudolf

I just had a 30 minute phone call with Will Rudolf, the CEO and President of the Biloxi Marsh Lands Company. He clarified some of the items in the latest quarter that I posted on and explained the issues that impacted my earlier attempts at communication.

I will post an entry a little later on the conversation.

Posted by

TJF

at

1:00 PM

0

comments

![]()

Labels: BLMC, Pink Sheets, Stocks

Wednesday, May 2, 2007

BLMC - Earnings Report

I don't want you to think I am obsessed with the company, but they released earnings and I wanted to review them since so few people pay attention to the stock and it is severely underanalyzed. The good thing about obscure stocks is that there are no expectations or guidance so it is impossible to miss expectations or guidance. The report was a little on the bearish side.

Here is a link to the news release on the company web site.

First Quarter 2007

Three items stand out in particular

1) Declining Production

The company reported that the combined gross daily production from 12 wells including those operated by TMR and Manti Jambi, Inc. was approximately 12.5 mmcf with net daily production accruing to the Company of approximately 1.6 mmcf. This was down from 21 mmcf with net daily production accruing to the Company of approximately 2.5 mmcf in the first quarter of 2006. The press release said that several wells run by Meridian Resources were shut in on March 31, 2007, which affected the quarters production. This is odd since the quarter ended on March 31, 2007, so it is hard to understand how a shut in of several wells on the last day of the quarter would hurt things so much. We would expect a normal decline rate on gas wells.

2) Drilling Delay

BLMC's new drilling subsidiary was to spud the first of five wells by March 31, 2007. This has been delayed to May 15, 2007 - 45 days. There was no explanation given for the delay. Maybe it was rig availability or they needed more time to study logs. Decline rates on existing wells are relentless and operators need to drill to keep production even with previous years.

3) No dividend

The company omitted its dividend for the quarter. It had hinted at it last year, and the shut ins and delays in drilling impacted cash flows enough that the company didn't make a payout. The dividend is one of the major attractions of the stock and I hope that it can resume a payout in the second quarter.

The good news is that the stock didn't budge from it perch at $34.00 per share.

It has ocurred to me that the day the wells were shut in was the around the same day I was pestering them with e-mails about setting up a meeting. That could explain why they did not respond.

Posted by

TJF

at

5:58 PM

0

comments

![]()

Labels: BLMC, Pink Sheets, Stocks

Monday, April 23, 2007

BLMC - Adieu

(Update - I did finally make contact with BLMC. See my other posts regarding this company.)

So I tried my best to get a sit down with the Biloxi Marsh Land Company - a fascinating pink sheet company that owns tens of thousands of acres of marshland in Louisiana. I was at an investment conference in New Orleans and actually stayed in Metarie right near their headquarters. It was a strange sequence of events and I must recount it here for the record:

Early March - Called BLMC and asked them to mail information on their exploration and devlopment potential that they presented at NAPE in February. They asked me to send an e-mail so they would have a record of it. (I honestly think that I forgot to send an e-mail as I was overworked on other issues.)

March 20 - Sent an e-mail asking for a face to face meeting with anyone in management.

March 20 - Received a very prompt e-mail answer from IR asking me to call Will Rudolf, the CEO of BLMC.

March 21 or 22 - I called BLMC and asked to speak to Mr. Rudolf. I was told that he was on the phone with a shareholder and that he would call back. (This was the last contact or response that I had with BLMC)

March 27 - Sent an e-mail to IR asking for a face to face meeting and received no response.

April 4 - Sent an e-mail post conference and included a list of my questions. I have received no response to date.

I don't understand why they responded to my initial e-mails and then suddenly cut me off from further contact. My questions really weren't all that tough either. I am not a shareholder activist type of hedge fund and wasn't going to ask them to recapitalize and pay out a huge dividend, etc. It was the inconsistency of the response that continues to puzzle me.

Here are my questions that I had for them. It would be difficult for me to invest money in this company until they were answered:

1. Has all the operations recovered fully from the hurricanes? Are all wells that were producing back on line?

2. Is the Manti Group the only operator currently drilling on your land? And they have committed to a 5 well package? Are they on schedule?

3. Your land is on your books at cost – which is $234,000 – I know you would never sell but do you have any idea of the current value?

4. On your balance sheet you have categories called:

Other investment – $1,775,995 - was not there at end of 2005. What is this investment?

Marketable Debt Securities - $4,732,349 at cost. What type of bonds? Are they all investment grade?

Marketable Debt and Equity Securities - $7,183,412 – this is not listed under current assets but under “investments” indicating that it is a long - term type of investment. What are the details of these investments?

5. What sort of insider ownership is there in BLMC?

6. What is the relationship between BLMC and the Lake Eugenie Land Company? Is there a cross ownership? Why do you call it your sister company?

7. What is the effect on the title to your land if the marsh land should become completely reclaimed by the ocean?

8. Would you ever consider moving onto NASDAQ or the AMEX? If not, is that by choice or because that you don't meet exchange requirements regarding numbers of shareholders, etc.

Posted by

TJF

at

12:33 PM

1 comments

![]()

Labels: BLMC, Howard Weil, Pink Sheets, Stocks

Saturday, March 31, 2007

Howard Weil

So I’m heading down to the Howard Weil conference in New Orleans. I’m passing Laurel, MS right now. This will be the first time I am attending as a hedge fund manager rather than a stodgy old long only investor. Do I think there are any bargains in energy? Not really. The OSX just broke through 200 recently, still below its high of 240 but no bargain either, especially after one company after another misses guidance – with HAL and NBR being the latest. They certainly aren’t value stocks.

So why am I going then? Well aside from the sumptuous food and drink, I feel like I am getting a little out of touch with the market and what is going on. Now this might come as a shock since I do despise the sell side but they are good at providing information and getting clues as to professional investor psychology. This may be of limited use as most of the positions in my hedge fund are too small or esoteric to be covered by Wall Street.

Another first for me is that I don’t have any one on ones set up at the conference. These are meetings with management that are the true purpose of the conference, as the presentations are just holding pens for institutional investors in between meetings.

I also tried to no avail to set up a meeting with the Biloxi Marsh Land Company (BLMC). I emailed them several times and called once but was ignored. It’s too bad because the company continues to fascinate me. Aside from its acreage position in Louisiana, the company has several cryptic entries on its balance sheet, i.e. short term and long term investments that may be carried at historical cost.

They also have some relationship with the Lake Eugenie Land Company (LKEU), another pink sheet company that is even more obscure than BLMC if such a thing is possible. I can find nothing on the Lake Eugenie Land Company, not even a market cap.

Posted by

TJF

at

12:37 PM

1 comments

![]()

Labels: BLMC, Energy, Howard Weil, LKEU

Wednesday, March 28, 2007

Biloxi Marsh Land Company (BLMC)

This is a very interesting company. It trades on the pink sheets under the symbol BLMC. Biloxi Marsh Lands Corporation was founded during the 1930s to acquire and own approximately 90,000 acres of wetlands in St. Bernard Parish, Louisiana.

The land they own is not buildable since it is essentially marshland, but the value in the company is the minerals (natural gas) that lie under its land. It has formed a subsidiary to partner with some operators to start development of this mineral potential. The company has no debt on its books and paid out a nearly 10% dividend last year.

I am attending a conference in New Orleans next week and I have been trying to arrange a meeting with the President but so far they have been a little squirrely about the entire thing. Hopefully, some things will come through in the next few days and I will have a meeting with management and post what I learned.

Posted by

TJF

at

3:05 PM

1 comments

![]()

Labels: BLMC, Pink Sheets, Stocks