Discover restricts credit further as seen in the e-mail below:

Discover Business Card Affiliates,

As a result of the current economic downturn, Discover Business Card has taken a look at credit risk and has made a decision to pause online acquisitions of its business products (Business Card, Business Miles and Business card with Cash Back Bonus) as of January 1st. At the turn of the year, the intention is to evaluate performance and the credit risk model so that the cards can once again be offered to online prospects in 2009.

Please note that this message relates only to Discover's Business Cards and not its Consumer or Student cards. You are free to continue to promote the latter and, in fact, we encourage you to do so in place of business cards.

Wednesday, December 24, 2008

Discover Crunches Credit Further

Posted by

TJF

at

2:28 PM

0

comments

![]()

Labels: Credit Crunch, Discover

Tuesday, December 23, 2008

An Update on the Energy Patch - Part II

I just returned from an Energy conference in New Orleans and wrote a little on it in this post here.

It seems that investors are waiting for three events before deciding whether to invest in these stocks in 2009.

First, to state the obvious, most institutional investors are waiting for the price of the commodity to stabilize, fearful for how far it will fall before a bottom is reached.

They also appear to be waiting until after the final round of exploration and production companies set capital budgets for 2009. While a decline in spending is discounted in the shares of the services and drilling companies, there is concern about how much more will be cut.

Also, many exploration and production companies will be forced to value reserves at the end of 2008 using a lower price deck than expected. This will cause reserve writedowns at many of these companies. Since "proving" up reserves is the main business model for many, this will also be a painful adjustment.

Posted by

TJF

at

7:27 AM

0

comments

![]()

Labels: Energy

An Update on the Energy Patch - Part I

I just returned from an Energy conference in New Orleans, and what a difference a year makes. At this same conference last year, if the maid who cleaned my hotel room wanted to raise a billion dollars to start an oil company, she probably could have gotten the capital. Not so this year, as a resigned outlook on the current downturn colored everyone's attitudes.

One company attendee told me that currently there was no spot market for rigs. As soon as a contract ended, the rig was being sent back to the owner. There is not even a conversation about a lower rate. It's basically - here's your rig, we'll call you.

Posted by

TJF

at

7:08 AM

0

comments

![]()

Labels: Energy

Monday, December 22, 2008

A Nineteenth Century View of Speculation that May Apply Today (Part II)

This is a continuation of my post from yesterday on a book published in 1887 called "Twenty Eight Years In Wall Street," written by a gentlemen called Henry Clews. He wrote an interesting section on speculation that I wanted to share:

"Speculation for a fall in prices is based upon the presumption of an over-supply. If it succeeds, the production of the particular product is checked until prices recover, and in the meantime production is diverted to articles less abundant. Thus speculation proves a regulator both of values and production. Speculation for a rise in prices is based upon a presumption of scarcity or short supply, and its direct effect is to quicken production and restore the equilibrium of prices."

This one is a perfect explanation for the rise in Oil prices, and the forces that corrected it to where it is today. These same forces will also lead to a recovery sometime in the future.

"Speculation, moreover, makes a market for securities that otherwise would not exist. It enables railroads to be built through the ready sale of their bonds, thus adding materially to the wealth of the whole country, and opening a more profitable market to labor. In this it becomes the forerunner of enterprise and material prosperity in business."

Without the lure and illusion of easy wealth that investing in the Stock Market provides to people, how much capital could American businesses attract?

"I believe the men of most experience, not only in Wall Street, but in other departments of finance and commerce, will bear me out in the statement that a market where even values are considerably inflated by speculation, is more desirable than a period of depression. The result, in the long run, is the greatest good to the greatest number. I don't believe that the ghost of Jeremy Bentham himself could rise up and consistently condemn this statement."

We shall find out of this is true since according to the conventional wisdom we are entering a depression.

Here is a direct link to the book.

Posted by

TJF

at

7:23 AM

0

comments

![]()

Labels: Speculation, Wall Street

Friday, December 19, 2008

A Nineteenth Century View of Speculation that May Apply Today

I recently came across a book published in 1887 called "Twenty Eight Years In Wall Street," written by a gentlemen called Henry Clews. He wrote an interesting section on speculation.

"Speculation is a method now adopted for adjusting differences of opinion as to future values, whether of products or securities."

I never quite thought of it that way but he does distill it down to a mathematical definition.

"This is more common now than in former years because the facilities for procuring information have increased with the greater intelligence and celerity with which all business is now conducted, and also from the greater rapidity with which such information can be transmitted by telegraph and cable."

Obviously, the "facilities for procuring information" was the nineteenth century equivalent of the Internet.

"Speculation brings into play the best intelligence as to the future of values. It has always two sides. The one that is based principally on the facts and conditions of the situation wins in the end, and the result of the conflict is the nearest possible approach to correct values. The consequences of speculation are thus financially beneficial to the country at large."

Is this where Warren Buffett got his famous line about the the voting machine and the weighing machine in regard to the Stock Market? What would Mr. Clews say about our recent spasm of speculative excess today? Is it beneficial to the country? If it is beneficial, then is our government doing the wrong thing in not letting it run its course?

Part II on Monday.

Posted by

TJF

at

9:05 AM

1 comments

![]()

Labels: Speculation, Wall Street

Saturday, December 13, 2008

Haven Trust Bank Fails

Haven Trust Bank of Duluth, Georgia, was the second bank to be seized by the Federal Deposit Insurance Corporation (FDIC) on Friday. My post on the first bank is here

Haven Trust bank had total assets of $572 million and total deposits of $515 million as of December 8, 2008. BB & T assumed the operations of the bank.

Haven Trust Bank was relatively new, and was formed in 2000, to ride the wave of real estate prosperity that engulfed the Southeast in the early part of this decade.

Its capital ratios were much lower than Sanderson State Bank, which was the other bank taken over by the FDIC on Friday:

Haven Trust Bank Capital Ratios (9/30/2008)

Equity capital to assets - 4.44%

Core capital (leverage) ratio - 4.42%

Tier 1 risk-based capital ratio - 4.90%

Total risk-based capital ratio - 6.16%

The bank had $437 million in real estate loans, with $260 million in Commercial Real Estate, and $133 million in the toxic construction and land development category.

Posted by

TJF

at

10:56 AM

0

comments

![]()

Labels: Bank Failures, FDIC, Federal Deposit Insurance Corporation, Haven Trust Bank

Sanderson State Bank of Texas Goes Down

We had a doubleheader by the Federal Deposit Insurance Corporation (FDIC) as they seized two banks on Friday evening. The first was the Sanderson State Bank of Texas.

This bank was taken over by the Pecos County Bank. Sanderson State Bank was a small bank and had total assets of $37 million and total deposits of $27.9 million at December 3, 2008.

Sanderson State Bank was first established in 1907, and had only one branch. It was able to survive the Panic of 1907, and the Great Depression in the 1930's, but not the most recent calamity to strike our economy.

The interesting thing to note was how quickly the situation deteriorated for Sanderson State Bank. At 9/30/2008, the bank had a Tier 1 risk-based capital ratio of 12.55%, and a Total risk-based capital ratio of 13.80%.

Ninety percent of its loans were real estate and maybe it was one concentrated loan that did them in. A sad end to a 100 year old bank.

Posted by

TJF

at

10:37 AM

0

comments

![]()

Labels: Bank Failures, FDIC, Federal Deposit Insurance Corporation

Friday, December 5, 2008

More Credit Tightening

I got this e-mail below from Discover today since I run an ad on my blog promoting its credit cards:

"Due to the recent economic downturn, Discover Business Card has made some changes to its lending criteria. After applying for a Discover Business Card, applicants may now be asked to provide additional information in order for Discover to make a credit decision. These changes will have an impact on the Discover Business Card approval rate and therefore you may likely see the overall conversion rate for the product decline. These changes were made in mid-November."

Just another brick in the wall I guess.

Posted by

TJF

at

10:45 AM

0

comments

![]()

Labels: credit cards, Credit Crunch

Thursday, December 4, 2008

Is The Housing Market About To Turn?

I know it is fashionable to be bearish on housing, but are things about to pivot and turn? Put these two items together:

1) The Housing Affordability Index reached 141.1 in the most recent release. This was the highest in at least six years. As one blogger noted, this will move even higher next month due to a drop in fixed mortgage rates to the current 5.75%.

2) The U.S. Treasury is considering a plan to drive mortgage rates down to as low as 4.5%. They would accomplish this by purchasing mortgage-backed securities from Fannie Mae and Freddie Mac.

Would low housing prices and a generational low in mortgage rates prove too tempting to home buyers and cause a mini boom in housing and begin to clear inventory?

Disclosure - I am long the XHB and ITB.

Posted by

TJF

at

6:06 AM

3

comments

![]()

Labels: Housing

Tuesday, November 25, 2008

Travel Trends - September 2008

Americans are still driving less, despite the fall in gas prices. The latest report through the end of September shows a 4.4% decline in miles driven, year over year. This equates to 10.7 billion less miles. This trend in driving less began last year and as can be seen in the chart below, is unprecedented in the last 25 years.

Posted by

TJF

at

8:21 AM

0

comments

![]()

Labels: Travel Trends

Monday, November 24, 2008

A Bloodbath Out There

I did a screen in Finviz, a great site that you should check out if you don't know about it, and only 11 stocks out of the S & P 500 are up year to date through the close on November 21. They are:

Family Dollar Stores (FDO)- Up 34.21%

Rohm and Haas (ROH)- 34.18%

UST Inc (UST)- 29.8%

Barr Pharmaceuticals (BRL)- 21.62%

Amgen (AMGN)- 18.22%

General Mills (GIS)- 16.62%

Walmart (WMT)- 12.79%

Hudson City Bancorp (HCBK)- 12.01%

Campbell Soup (CPB)- 3.48%

Celgene (CLGN) - 2.79%

People's United Financial (PBCT) - 1.63%

Surprisingly, two banks are on the list. There are three biotech/pharm companies, and a few staples. Rohm and Haas is being bought by Dow Chemical, which explains its resilient performance. UST is also being purchased by Altria.

Hudson City Bancorp turned down the government investment via the Capital Purchase Plan, and People's United Financial just replaced Unisys two weeks ago.

Posted by

TJF

at

6:49 AM

0

comments

![]()

Labels: Stocks

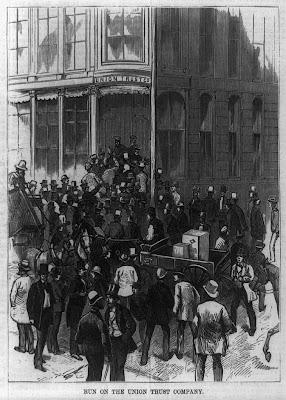

Will This Be Citibank on Monday Morning?

An engraving from the run on the Union Trust Company during the Panic of 1873.

Will This Be Citibank on Monday Morning? No, it won't but the market seems just as scared nonetheless.

Posted by

TJF

at

6:14 AM

0

comments

![]()

Labels: Banks

Saturday, November 22, 2008

FDIC Triple Header - The Community Bank of Loganville, Georgia

The third bank closed by the FDIC yesterday. From the press release of the FDIC:

"The Community Bank, Loganville, Georgia, was closed today by the Georgia Department of Banking and Finance, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Bank of Essex, to assume all of the deposits of The Community Bank."

"The Community Bank's four branches will open on Monday, November 24, 2008 as Bank of Essex. Depositors of the failed bank will automatically become depositors of Bank of Essex. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship to retain their deposit insurance coverage."

"The Community Bank had total assets of $681.0 million and total deposits of $611.4 million. Bank of Essex purchased approximately $84.4 million of The Community Bank's assets, and did pay the FDIC a premium of $3.2 million for the right to assume the failed bank's deposits. The FDIC will retain the remaining assets for later disposition."

"The transaction is the least costly resolution option, and the FDIC estimates that the cost to its Deposit Insurance Fund will be between $200 million and $240 million. The Community Bank is the twentieth FDIC-insured institution to be closed nationwide, and the third in Georgia, this year."

Posted by

TJF

at

7:22 AM

0

comments

![]()

Labels: Bank Failures, FDIC, Federal Deposit Insurance Corporation

FDIC Triple Header - Downey Savings and PFF Bank

The FDIC did a triple header Friday night with three banks going down. From the FDIC press release:

"U.S. Bank, National Association, Minneapolis, MN, acquired the banking operations, including all the deposits, of Downey Savings and Loan Association, F.A., Newport Beach, CA, and PFF Bank & Trust, Pomona, CA, in a transaction facilitated by the Federal Deposit Insurance Corporation."

"The combined 213 branches of the two organizations will reopen as branches of U.S. Bank under their normal business hours, including those with Saturday hours. Depositors will automatically become depositors of U.S. Bank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship to retain their deposit insurance coverage."

"Customers of both banks should continue to use their existing branches until U.S. Bank can fully integrate the deposit records of the organizations. Over the weekend, depositors can access their money by writing checks or using ATM or debit cards.

As of September 30, 2008, Downey Savings had total assets of $12.8 billion and total deposits of $9.7 billion. PFF Bank had total assets of $3.7 billion and total deposits of $2.4 billion. Besides assuming all the deposits from the two California banks, U.S. Bank will purchase virtually all their assets. The FDIC will retain any remaining assets for later disposition."

"The FDIC and U.S. Bank entered into a loss share transaction. U.S. Bank will assume the first $1.6 billion of losses on the asset pools covered under the loss share agreement, equal to the net asset position at close. The FDIC will then share in any further losses. Under the agreement, U.S. Bank will implement a loan modification program similar to the one the FDIC announced in August stemming from the failure of IndyMac Bank, F.S.B., Pasadena, CA."

Posted by

TJF

at

7:16 AM

1 comments

![]()

Labels: Bank Failures, FDIC

Thursday, November 13, 2008

Hedge Fund Kingpins Testify - Highlights

Here are some of the highlights from the prepared statements today in front of the House Committee on Oversight and Government Reform by the five famed Hedge Fund managers.

Phillip Falcone of Harbinger Capital Partners

"I would like to take just a moment to tell you a bit about myself. I currently reside in New York City with my wife of 11 years and two children. By way of background, I was born in Chisholm, Minnesota, population 5,000, on the Iron Range in Northern Minnesota. I was the youngest of nine kids who grew up in a three-bedroom home in a working class neighborhood. My father was a utility superintendent and never made more than $14,000 per year, while my mother worked in the local shirt factory. I take great pride in my upbringing, and it is important for the Committee and the public to know that not everyone who runs a hedge fund was born on 5th Avenue - that is the beauty of America."

More later.

Posted by

TJF

at

9:23 PM

3

comments

![]()

Labels: Hedge Fund

Sunday, November 9, 2008

FDIC Seizes Security Pacific Bank

Security Pacific Bank of Los Angeles, California was closed by the FDIC last Friday. The agency had a busy weekend as this was the second bank seized by the government on Friday. Pacific Western Bank assumed the deposits of the failed bank.

Final Stats (9/30/08):

Tier 1 leverage ratio - 3.14%

Tier 1 risk-based capital ratio - 3.71%

Total risk-based capital ratio - 5.00%

Noncurrent loans to loans - 19.94% at 6/30/2008.

News reports say that the bank was done in by loans to Homebuilders in the Inland Empire area of California.

Posted by

TJF

at

4:25 PM

0

comments

![]()

Labels: Bank Failures, FDIC

Franklin Bank, S.S.B., Houston, Texas Closed By The FDIC

Franklin Bank, S.S.B., Houston, Texas was closed by the FDIC on Friday.

Prosperity Bank of El Campo, Texas, assumed all of the deposits of Franklin Bank. Franklin Bank had total assets of $5.1 billion and total deposits of $3.7 billion. The bank was relatively new and was founded in 1987 as the Bowie State Bank.

It looks like Construction, land development, and other land loans did them in. The bank had $1.2 billion of these loans at 9/30/08, and $400 million were 30 days past due or in non accrual status.

Final stats on the failed bank:

Tier 1 leverage ratio - 2.11%

Tier 1 risk-based capital ratio - 3.37%

Total risk-based capital ratio - 5.11%

Noncurrent loans to loans - 11.06% (6/30/2008)

Capital ratios as of 9/30/2008.

Just to demonstrate how quickly capital can erode. The bank had a total risk-based capital ratio of 10.16% at 6/30/08.

Posted by

TJF

at

4:05 PM

0

comments

![]()

Labels: Bank Failures, FDIC

Tuesday, November 4, 2008

The Empire Strikes Back

On October 24, 2008, I posted on a paper from the Minneapolis Federal Reserve entitled "Facts and Myths about the Financial Crisis of 2008"

The paper listed what it called four myths that have arisen during the financial crisis:

1) Bank lending to non financial corporations and individuals has declined sharply.

2) Interbank lending is essentially nonexistent.

3) Commercial paper issuance by non financial corporations has declined sharply, and rates have risen to unprecedented levels.

4) Banks play a large role in channeling funds from savers to borrowers.

The Federal Reserve Bank of Boston has now counter punched with its working paper called "Looking Behind the Aggregates: A Reply to “Facts and Myths About the Financial crisis of 2008”

The conclusion:

"As Chari et al (2008) point out in a recent paper, aggregate trends are very hard to interpret. They examine four common claims about the impact of financial sector phenomena on the economy and conclude that all four claims are myths. We argue that to evaluate these popular claims, one needs to look at the underlying composition of financial aggregates. Our findings show that most of the commonly argued facts are indeed supported by disaggregated data."

Posted by

TJF

at

11:00 AM

0

comments

![]()

Labels: Federal Reserve, Financial Crisis

Monday, November 3, 2008

Things We Wish We Had Done Two Years Ago

From the press release of Corus Bankshares (CORS) last week:

“Corus did not originate any new loans in the third quarter of 2008. Given the uncertain condition of the commercial real estate market, and our desire to bolster our capital ratios, management has decided that this is not the right time to originate new loans. We hope that events will transpire over the coming quarters such that we will again feel comfortable originating loans.”

Corus is a major lender in South Florida for condos, where half its loans are non accrual or close to it.

Posted by

TJF

at

7:49 AM

0

comments

![]()

Labels: CORS, Corus Bankshares

Saturday, November 1, 2008

Bank Death Watch - Freedom Bank of Bradenton, Florida

The Freedom Bank of Bradenton, Florida failed last Friday. Its deposits were taken over by Fifth Third Bank. The bank was publicly traded on the OTC bulletin board under the symbol FBBF.

The bank started the year with $25 million in Equity capital, but by the end of the third quarter, capital was only $10 million. The capital ratios in the last call report (9/30/2008) were fairly gruesome:

Tier One Leverage - 2.0%.

Tier 1 risk-based capital ratio - 2.2%.

Total risk-based capital ratio - 3.45%.

The bank had $211 million in loans outstanding at 9/30/08, most of which were Real Estate loans.

Construction and Land Development - $176 million.

Commercial and Industrial - $32 million.

Noncurrent loans to loans - 15.49% (as of 6/30/2008)

In July, a private equity fund called Community Bank Investors of America LP, agreed to invest $5 million in the bank subject to it raising more capital elsewhere. I can't find any record of the fund completing the deal.

Posted by

TJF

at

5:38 PM

0

comments

![]()

Labels: Bank Failures, FDIC

Friday, October 24, 2008

Alpha Bank & Trust - Another Bank Failure

The Alpha Bank & Trust, of Alpharetta, GA was closed by the FDIC today. The deposits were assumed by Stearns Bank, of St. Cloud, Minnesota.

Press Release

Final Stats

Assets in nonaccrual status - 15.39%

Noncurrent loans to loans - 18.36%

Noncurrent assets plus other real estate owned to assets - 19.78%

Construction and land development loans - 61.02%

Core (Retail) deposits - 77.40%

Equity capital to assets - 5.20%

Core capital (leverage) ratio - 5.27%

Tier 1 risk-based capital ratio - 5.67%

Total risk-based capital ratio - 6.96%

(All data as of 6/30/08)

Posted by

TJF

at

3:20 PM

0

comments

![]()

Labels: Bank Failures, FDIC

What Credit Crisis?

A new working paper from the Federal Reserve of Minneapolis says that four myths have been created during the financial crisis and perpetuated by the media and others.

"Here we examine four claims about the way the …financial crisis is affecting the economy as a whole and argue that all four claims are myths. Conventional analyses of the …financial crisis focus on interest rate spreads. We argue that such analyses may lead to mistaken inferences about the real costs of borrowing and argue that, during …financial crises, variations in the levels of nominal interest rates might lead to better inferences about variations in the real costs of borrowing."

The four myths:

1)Bank lending to nonfinancial corporations and individuals has declined sharply.

2)Interbank lending is essentially nonexistent.

3)Commercial paper issuance by nonfinancial corporations has declined sharply, and rates have risen to unprecedented levels.

4)Banks play a large role in channeling funds from savers to borrowers.

The authors present an impressive number of charts and statistics to support the conclusion. I would love to go through these one by one, but unfortunately the market seems to be crashing again. Here is the conclusion from the three authors:

"Our analysis has raised questions about the claims made for the mechanism whereby the financial crisis is affecting the overall economy. We emphasize that we do not dispute that the United States is undergoing a …financial crisis and that the United States economy may be in a recession or may experience one in the near future. Our analysis is based on publicly available data. Policymakers have access to other sources of data as well. Policymakers could well believe that bold action is necessary based on data that are different from that considered here. If so, responsible policymaking requires that they share both the data and the analysis that underlies the need for bold policy with the public."

Posted by

TJF

at

6:19 AM

1 comments

![]()

Labels: Federal Reserve

Tuesday, October 14, 2008

Investing Carnival # 17

Welcome to the October 14, 2008 edition of the Investing Carnival supported by the members of The Dividend and Value Investing Network - The Div-Net. This is the seventeenth edition of the Carnival.

Stock Analysis

D4L presents Stock Analysis: United Technologies Corp (UTX) A Buy At This Price posted at Dividends4Life.

The DIV-Net presents Chevron Corporation (CVX) Dividend Stock Analysis posted at Dividend Growth Investor.

Bill presents Lowes is Too Low posted at Learn The Stock Market And How to Trade.

The Rest

Paul Goodwin presents Back to the Basics … Again posted at The Iconoclast Investor.

Super Saver presents Municipal Bonds Funds Yielding Over 4% posted at My Wealth Builder.

John Lee presents WEEKLY TECHNICAL COMMENTARY: TODAY'S BREAKOUTS & BREAKDOWNS posted at WEEKLY TECHNICAL COMMENTARY.

KCLau presents How Fundsupermart will Revolutionize the Unit Trust Industry in Malaysia posted at KCLau's Money Tips.

FIRE Finance presents Tax FREE Money Market Mutual Funds posted at FIRE Finance.

The Financial Blogger presents Behind The Financial Crisis: Credit Default Swaps posted at The Financial Blogger.

MBB presents The Top 5 Online Savings Banks posted at Money Blue Book Finance Blog.

Tushar Mathur presents Looking For A College Fund Bailout posted at Everything Finance.

Qovax presents Valuing a Business - Seth Klarman’s 3 Methods posted at Value Investing and Entrepreneurship by Qovax, a Software Startup.

Sandy Naidu presents Warren Buffet?s Advice posted at Future Nest Egg.

praveen presents Taking out the DOG... posted at My Simple Trading System.

Ryan Suenaga presents It’s Okay to be Afraid, but it’s Important to be Brave posted at Uncommon Cents.

Lazy Man presents Jim Cramer: Sell Your Stocks posted at Lazy Man and Money.

Alexander presents It’s Time to Give Your Financial Planner a Call posted at Wealth Junkies.

Silicon Valley Blogger presents A Profitable Stock Sale: Sold The Bank Shares in my 401k Account posted at The Digerati Life.

Dorian Wales presents The Credit Crisis Presents a Rare Opportunity for Learning and Experience posted at The Personal Financier.

sherin presents How do you prepare for losing your job posted at Investment Internals.

Mr. ToughMoneyLove presents Investors Have Capitulated – Now What? posted at Tough Money Love: Hard Truth about Money and Personal Finance.

Kevin presents Why Jim Cramer Thinks You Shouldn?t Be in Stocks posted at No Debt Plan.

Posted by

TJF

at

5:22 AM

5

comments

![]()

Labels: Investing Carnival

White Mountains Insurance (WTM) Analyst Day – Q and A - Part Two

WTM Analyst Day – Q & A – June 17, 2008

This is part two of a rough transcription of the Question and Answer period from the White Mountains Analyst day held on June 17, 2008.

Here are the other posts I have written on the meeting:

WTM - Introductory Comments

WTM - The Reserve Issue

WTM - Review of One Beacon

WTM - Review of White Mountains Re

WTM - Review of Esurance

WTM - Investment Portfolio

WTM - Berkshire Transaction

WTM - Q and A - Part I

Has compensation been tied to long-term results?

LT comp has always been tied to results – using a formula to calculate. Short term can be a lot of discretion by CEO of units on short-term comp.

Since this happened on underwriting from six years ago – can more be tied to long term?

We have both ST and LT comp – whether the claims were there 6 year sago is irrelevant in deciding on comp – three years of adverse reserve development in a row - we are having a debate now in the company – a lot of these people were not here six years ago but they were here last year.

WTM Solutions – run off business – getting more activity?

Waxes and wanes with cycle as competitors get more stressed - yes, seeing more activity – pace is picking up – not enough pain felt just yet.

Person who used to run this retired last year but good team. They study 30 deals they get one. Neil Wasserman is in charge – part of team – confident in him. The expense base is $3 million a year so one deal basically pays for WTM Solutions.

Municipal Bond underwriting?

Looked at a lot of things – it is a good market – used to be in FSA – sold it in 2000 – kept some that was sold back last year. A good business – BRK is there – nothing yet that will benefit. Looked with partners starting 9 or 10 months ago.

We have done modeling on losses on sub prime guarantees done by insurers and come up with losses much higher – made a decision not to invest in existing insurer. Our hurdle is very high – high capital.

Globalization of Insurance business?

Look at it all the time – insurance is very local – would not go into Israel or Russia unless had someone who knew it well. Do not have the pretense that we can go into others markets and do better than them.

NOLS- Esurance - $300 million – is it currently being used?

Esurance is generating NOL’s - Gary sees a path to GAAP profitability reasonably soon so will soon use them pretty quickly. The AnswerFinancial NOL’s - we valued them knowing that we wouldn’t be used quickly - discounted them significantly – we hoping to do better than our own plans – we did not overpay.

BRK transaction?

Waiting for private letter ruling from IRS on taxability – have had conversations with them already.

Esurance conversion ratio of 8% - is that constant?

In 2000, conversion rate was 2% - up 1% compared to last year – improving the process – improving web site – always trying to improve. Not sure about competitors – believe that GEICO id higher – brand is important – so is pricing – on the phone conversion rate is 15%. AF conversion rate is 30% because they offer other carriers.

Are you OK with pricing vs. comp?

Not as competitive as a year ago – we took price increase in 18 states about up 9% because severity was going up – can see how comp they are by stet – CA very competitive – just raised rates in Florida so probably not that competitive there anymore. GEICO probably the most competitive on prices.

Symetra valuation last year was to be IPO’s at 1.4 times book. Is that current?

Can’t directly comment – that’s what it was last year and we were comfortable with it.

Are you shifting assets away from Energy in investing portfolio?

Have shifted from winners to laggards but overall weighting the same.

Posted by

TJF

at

5:12 AM

0

comments

![]()

Labels: White Mountains Insurance, WTM, WTM Analyst Day 2008

Monday, October 13, 2008

The Bad News On White Mountains Insurance Is Out

White Mountains Insurance has fallen precipitously the last month with the rest of the insurance group, and all of us knew something was coming either in regard to the mortgage backed securities portfolio, or the Level III asset portfolio which consists mostly of long/short investment partnerships, according to management. The company issued a press release this morning with the details:

"In light of recent developments in financial markets, White Mountains Insurance Group, Ltd. (the "Company") announced today that it expects its adjusted book value per share at September 30, 2008 to be between $400 and $420, a reduction from $444 at June 30, 2008. These results have not been reviewed by the Company's independent auditors and are subject to change."

The stock is now up $43 to $338 so it sells at 80% of book value.

"The reduction is due mainly to a 5% drop in the value of invested assets during the quarter. The total return on fixed maturity investments, including mortgage-backed and asset-backed securities, was -2% to -3% for the quarter, compared to a return of -0.5% for the Lehman Aggregate Index. The total return on equity securities was between -13% and -15%, compared to -8.4% for the S&P 500."

Not bad, many did much worse.

"Our underwriting results for the quarter were impacted by after tax catastrophe losses of roughly $100 million. For the quarter, our segment GAAP combined ratios are estimated to be as follows: OneBeacon, about 100%; White Mountains Re, about 120%; and Esurance, about 102%. Mark-to-market losses on the White Mountains Life Re portfolio were about $15 million."

OK, the insurance business sucks as well, but we all knew that too.

"Finally, we expect to receive final approval from the IRS on the Berkshire exchange by the end of October and to close that transaction soon thereafter."

The company stands behind its word, and will pay Berkshire $485 a share. No private equity cop out here.

As previously disclosed, White Mountains does not invest in any collateralized loan obligations or collateralized debt obligations. The Company's high quality, short duration fixed maturity portfolio remains defensively positioned and had minimal exposure to the adverse credit events during the third quarter. As of June 30, 2008, the Company had $2.6 billion in mortgage-backed securities, which represented 57% of the Company's shareholders' equity. $1.5 billion of the Company's mortgage-backed securities owned at June 30, 2008 carry the full faith and credit guaranty of the U.S. government. As of September 30, 2008, the total mortgage-backed security portfolio was approximately $2.6 billion. Management remains comfortable with the credit outlook of this short duration, high quality portfolio."

Disclosure - I am long WTM.

Posted by

TJF

at

10:40 AM

0

comments

![]()

Labels: White Mountains Insurance, WTM

White Mountains Insurance (WTM) Analyst Day – Q and A

WTM Analyst Day – Q & A – June 18, 2008

This is a rough transcription of the Question and Answer period from the White Mountains Insurance Analyst day held on June 17, 2008.

My other posts on the meeting:

WTM - Introductory Comments

WTM - The Reserve Issue

WTM - Review of One Beacon

WTM - Review of White Mountains Re

WTM - Review of Esurance

WTM - Investment Portfolio

WTM - Berkshire Transaction

Advantages of having Answer Financial and Esurance together?

We get a lot of traffic to Esurance – 3.5 million quotes this year – people coming to the site - our conversion rate for online buyers is around 8% - the rest are going somewhere else - we are paying anywhere from $250-300 to get a policy – I am trying to monetize that traffic. We also get traffic from states where we don’t do business – only in 28 states – 30 by the end of the year right now we sell that traffic but would be better to keep it in house and give it to AF and use it build their volume.

Write most of our business online Seventy percent of our customers go through process without talking to anyone – 30% get someone on line at call center - people who buy online – their loss ratios are 15 points below people who buy on phone – the rest are better handled by AF. We also want AF to sell more of our business – right now only 10% and want to move it to 20%.

Have gas prices impacted miles driven which impacts claim frequency?

Frequency is really coming down – year over year through 1Q 08 - down 4% - thought it would be flat and in May it was down 8%. I think people are driving fewer miles and hopefully slower – flip side is that cars are smaller which may lead to higher severity of claims. Claim inflation may also be an issue going forward.

Monetizing Assets?

At this price we are a buyer of our stock – whether we can monetize any of our assets we look at this all the time. We talk to people who are interested. In current market odds are we are a better seller than buyer.

Who initiated BRK transaction?

When I (Barrette) got back a year ago the company had been working extensively on the deal…started somewhere in conversation between Jack and Warren – not sure who started it but it clearly got going – almost reached a deal a year ago but it didn’t – then I understood his parameters better - basically he needed to sell at market – did not want a below market price – when price hot my price and I knew he was a seller at that price that’s when the deal got done.

Is there a material change clause in BRK deal?

No clause…only if IRS doesn’t approve.

What could drive the $21 million reversal in Q2?

A GAAP market to market of our liabilities – when markets a very volatile and you have low interest rates in Japan we assume that they will maintain that for next 8 ½ years – what needs to reverse that it higher rates in Japan or lower volatility.

How much of WTM Re America (Folks) book is ceded?

WTM Re America is ceding 75% of property business and 50% of casualty business down to Bermuda – would increase them somewhat maybe to 80% each. That’s of the WTM Re America (Folks) book.

More color on limited partnerships that dominate Level 3 assets?

Three quarters are long short equity partnerships – in terms of transparency we get monthly reporting from them – audited annually – get a portfolio list – in touch with the managers – strategies do not have a lot of leverage. Can get losses from pilot error but won’t get compound damage from leverage – mostly Value managers - $2 billion from Prospector – reason why most are Level 3 is lag time on reporting.

$140 million reserve – what has company learned institutionally?

Now WTM will have a Chief Actuary – some form of dotted line reporting to corporate people – so the CFO of units don’t feel that CEO of unit can dictate to them. We will due diligence more regularly and more reserve meetings.

Posted by

TJF

at

7:38 AM

0

comments

![]()

Labels: White Mountains Insurance, WTM, WTM Analyst Day 2008

Friday, October 10, 2008

White Mountains Insurance (WTM) Analyst Day - Berkshire Transaction

White Mountains Insurance (WTM) held its annual analyst meeting on June 17, and I finally got around to listening to the webcast. The URL is here if you want to listen yourself.

I have written six other posts on the meeting. They are:

WTM - Introductory Comments

WTM - The Reserve Issue

WTM - Review of One Beacon

WTM - Review of White Mountains Re

WTM - Review of Esurance

WTM - Investment Portfolio

Berkshire Transaction

WTM discussed the Berkshire transaction in a little more detail. In March 2008, WTM announced an agreement with Berkshire Hathaway to buy back 1,724,200 of WTM shares that they held. WTM would pay $751 million and transfer two insurance entities that are in run off. The two subsidiaries are Commercial Casualty Insurance Company and International American Group. The shares held by Berkshire Hathaway represent 16.3% of the company. The aggregate exchange value is $836 million, or $485 per share.

Management said “As our founding father Jack Byrne says, you shoot ducks not when the gun is loaded but when the ducks are flying….we had a lot of activity last year but the ducks weren’t flying. But when we got to this year, and we got some additional capital…and there was a duck that was quacking, and that duck was our own stock.”

“We had the opportunity to create this exchange with BRK, which valued WTM at $485 per share or 1.1 times book.”

“Ben Graham would say when you look at a company and if you can get that company in at a 20% discount to its intrinsic business value, that’s an attractive time to do something there is no company we know better than our own so being able to do a transaction where we value WTM at $485 and then had 2 run off businesses valued at 1.5 times book, we value that as a very attractive proposition.”

Management went out of its way to assure investors that the company would have the capacity to make acquisitions if needed despite the outflow of cash to buy its shares from Berkshire. Debt to total tangible capital would be 22% and total debt would be $1.3 billion on a pro forma basis.

WTM said that the deal had been under discussion for quite some time and that the two companies almost reached agreement a year ago. The sale is expected to close in the third quarter.

My Comments:

With WTM closing at $310 on 10/09/2008, this deal looks like a steal for Berkshire, although I haven't seen a press release announcing the close of the deal. Does WTM want to use its precious capital in this manner during this crisis?

Posted by

TJF

at

8:19 AM

0

comments

![]()

Labels: Berkshire Hathaway, White Mountains Insurance, WTM, WTM Analyst Day 2008

Thursday, October 9, 2008

Another Unthinkable Event

Is the unthinkable going to happen? What do I mean? How about the government closing the stock exchange to try to induce calm in the market. I am not talking about a circuit breaking close for a half an hour. I am referring to a multi day or week long halt. It's not as farfetched as it sounds, Roosevelt closed the banks in 1933.

Here are some major historical closing for the NYSE:

July 31 - Nov. 27, 1914 - Outbreak of World War I.

March 6 - 14, 1933 - Banking holiday.

September 11-14, 2001 - Terrorist Attacks.

I'm not saying that closing the exchange will work, as it may have the opposite effect, and many of these stocks trade off the exchange or overseas.

The full list of closings.

Posted by

TJF

at

3:14 PM

0

comments

![]()

Labels: NYSE

This Is Insane

Wesco Financial (WSC) is down $58 or 17%. This is the insurance company run by Charlie Munger, who sits next to Warren Buffett at every annual meeting of Berkshire. Does the market really feel that Wesco is going to take a loss because it owns CDO's or some other toxic paper?

Posted by

TJF

at

2:57 PM

2

comments

![]()

Labels: Charlie Munger, Warren Buffett, Wesco

Is Oil Demand Falling Off A Cliff?

Is demand for oil falling off a cliff with the stock market?

The Department of Energy reports that the U.S. Petroleum Products Product Supplied was only 18.66 million barrels per day for the four weeks ending October 3.

This is the lowest level since June 1999.

Posted by

TJF

at

8:52 AM

0

comments

![]()

Labels: Oil, Oil Demand

Thursday, September 25, 2008

The FDIC Rips Into Bloomberg

It seems that Bloomberg has angered the powers that be at the Federal Deposit Insurance Corporation (FDIC) with its recent article suggesting that the FDIC may need more money to bail out banks than is currently in its fund. Here is the Bloomberg article and the FDIC response is printed below:

Bloomberg reporter David Evans' piece ("FDIC May Need $150 Billion Bailout as Local Bank Failures Mount," Sept. 25) does a serious disservice to your organization and your readers by painting a skewed picture of the FDIC insurance fund. Let me be clear: The insurance fund is in a strong financial position to weather a significant upsurge in bank failures.

The FDIC has all the tools and resources necessary to meet our commitment to insured depositors, which we view as sacred. I do not foresee – as Mr. Evans suggests – that taxpayers may have to foot the bill for a "bailout."

Let's look at the real facts about the FDIC insurance fund. The fund's current balance is $45 billion – but that figure is not static. The fund will continue to incur the cost of protecting insured depositors as more banks may fail, but we continually bring in more premium income.

We will propose raising bank premiums in the coming weeks to ensure that the fund remains strong. And, at the same time, we will propose higher premiums on higher risk activity to create economic incentives for poorly managed banks to change their risk profiles. The fund is 100 percent industry-backed. Our ability to raise premiums essentially means that the capital of the entire banking industry – that's $1.3 trillion – is available for support.

Moreover, if needed, the FDIC has longstanding lines of credit with the Treasury Department. Congress, understanding the need to ensure that working capital is available to the FDIC to provide bridge funding between the time a bank fails and when its assets are sold, provided broad authority for us to borrow from Treasury's Federal Financing Bank. If necessary, we can potentially raise very large sums of working capital, which would be paid back as the FDIC liquidates assets of failed banks. As per our authorizing statute, any money we might borrow from the Treasury must be paid back from industry assessments. Only once in the FDIC's history have we had to borrow from the Treasury – in the early 1990s – and that money was paid back with interest in less than two years.

Finally, Mr. Evans' suggestion that the "government" could ever be "on the hook for uninsured deposits" demonstrates a misunderstanding of FDIC insurance. To protect taxpayers, we are required to follow the "least cost" resolution, which means that uninsured depositors are paid in full only if this is the least costly option for the FDIC. This usually occurs when a bidder for the failed bank is willing to pay a higher price for the entire deposit franchise. We are authorized to deviate from the "least cost" resolution only where a so-called "systemic risk" exception is made. This is an extraordinary procedure which we have never invoked. And again, any money we borrow from the Treasury Department must be repaid through industry assessments.

I am confident in the strength of the FDIC's resources to make good on our sacred pledge to insured depositors. And, remember, no depositor has ever lost a penny of insured deposits, and never will.

Andrew Gray

Director

Office of Public Affairs

Federal Deposit Insurance Corporation

Posted by

TJF

at

2:36 PM

3

comments

![]()

Labels: Bloomberg, FDIC, Federal Deposit Insurance Corporation

Monday, September 22, 2008

New Federal Reserve Rules

The Federal Reserve Board just issued two new rules. The first temporarily exempts bank holding companies from leverage and risk-based capital rules.

"The first interim final rule would provide a temporary limited exception from the Board's leverage and risk-based capital rules for bank holding companies and state member banks."

The second rule allows bank holding companies to do transactions they weren't allowed to do on Friday.

"The second would provide a temporary limited exception from sections 23A and 23B of the Federal Reserve Act, which establish certain restrictions on and requirements for transactions between a bank and its affiliates."

Posted by

TJF

at

10:29 AM

1 comments

![]()

Labels: Federal Reserve, Goldman Sachs, GS, Morgan Stanley, MS

Festival of Stocks # 107

I am the proud host of the Festival of Stocks. This is actually the seventh time I have hosted the festival. I received many entries this week on the current financial crisis which is obviously on the minds of many investors.

Stock Analysis

Dividends4Life presents Stock Analysis: McGraw-Hill Companies Inc (MHP) posted at Dividends4Life.

Saj Karsan presents World Wrestling Pays! posted at Barel Karsan.

George presents Buying More Sotheby's posted at Fat Pitch Financials.

Roy Ward presents Problems with Garmin posted at The Iconoclast Investor.

Steve Alexander presents Magic Formula Stock Review: Bare Escentuals (BARE) posted at MagicDiligence - Optimizing Joel Greenblatts Value Stock Strategy.

Martin Roth presents Six new stocks for NASDAQ Clean Edge Index - Green Technology Investor: helping you profit from the world's best green-tech stocks posted at Green Technology Investor.

Jim presents I Just Day-Traded AIG, It’s Dangerous & Addicting posted at Blueprint for Financial Prosperity.

Andy presents Another Inevitable Government (AIG) Billion Dollar Bailout posted at $aving to Invest.

The Financial Crisis

Joseph Osodi presents COLLAPSE OF GLOBAL STOCK MARKET « Josephekwu’s Weblog posted at Josephekwu's Weblog.

Michael Cintolo presents 10 Observations About This Financial Storm posted at The Iconoclast Investor.

Babak presents Reviewing The Carnage On Wall Street posted at Trader's Narrative.

Alexander presents Watching A Scary Stock Market posted at Wealth Junkies.

LAL presents What a week and it’s not done yet… posted at LivingAlmostLarge.

praveen presents Lehman, Merril Lynch, and AIG Lead to The "Unbubble" posted at My Simple Trading System.

Silicon Valley Blogger presents Best Places For Your Money When The Stock Market Tanks posted at The Digerati Life.

The Smarter Wallet presents How to Protect Yourself Against the Economic Crisis posted at The Smarter Wallet.

Ironman presents Hey Look - Brownian Motion! posted at Political Calculations.

Ryan Suenaga presents Why Ginnie Mae isn’t in the Same Boat as Fannie Mae and Freddie Mac posted at Uncommon Cents.

Posted by

TJF

at

6:30 AM

2

comments

![]()

Labels: Festival of Stocks

Sunday, September 21, 2008

The Bailout Plan

Here are some excerpts from the plan announced by the Treasury last week to spend up to $700 billion to buy assets from financial institutions.

"Treasury will have authority to issue up to $700 billion of Treasury securities to finance the purchase of troubled assets."

What are the two reasons for doing this?

"to promote market stability, and help protect American families and the US economy."

What can the Treasury buy?

"Residential and commercial mortgage-related assets, which may include mortgage-backed securities and whole loans."

But, we can basically buy whatever we want:

"The Secretary will have the discretion, in consultation with the Chairman of the Federal Reserve, to purchase other assets, as deemed necessary to effectively stabilize financial markets."

We are only bailing out domestic financial institutions:

"Participating financial institutions must have significant operations in the U.S."

But, if we want to bail out foreigners, we will:

"...unless the Secretary makes a determination, in consultation with the Chairman of the Federal Reserve, that broader eligibility is necessary to effectively stabilize financial markets."

We will tell you what we are doing:

"Within three months of the first asset purchases under the program, and semi-annually thereafter, Treasury will provide the appropriate Congressional committees with regular updates on the program."

Because we know you won't understand it anyway.

Posted by

TJF

at

8:26 AM

0

comments

![]()

Saturday, September 20, 2008

Bunning Tries to Shut Down the Federal Reserve

Senator Jim Bunning, a Republican from Kentucky, tries to shut down the Federal Reserve with the following bill that will no doubt go absolutely nowhere:

S.3510 : A bill to prohibit the Board of Governors of the Federal Reserve System from making funds available at a discount rate to private individuals, partnerships, and corporations.

Latest Major Action: 9/17/2008 - Referred to Senate committee.

Status: Read twice and referred to the Committee on Banking, Housing, and Urban Affairs.

Posted by

TJF

at

7:18 AM

3

comments

![]()

Labels: Bunning, Federal Reserve, Senate

Friday, September 19, 2008

A Strange Coincidence

Is it just a coincidence that on the day the Securities and Exchange Commission (SEC) bans short selling in 799 Financial stocks, the sign below mysteriously appears nailed to a fence in Suburban Birmingham, Alabama.

Stock Loan, of course, is the official name of the departments at Wall Street firms which handle the borrowing of stock for clients who want to sell short. Someone getting out of the business perhaps?

Posted by

TJF

at

3:49 PM

0

comments

![]()

Labels: Short Selling, Stock Loan

Financial Stocks Not On The Banned List

I found a few Bank stocks not on the list of 799 stocks that can't be sold short per the Securities and Exchange Commission (SEC) order this morning. They are all Bulletin Board or Pink Sheet stocks so I am not sure if they can be borrowed anyway, but here are some of them:

Wake Forest Bancshares (WAKE)

Oxford Bank Corp (OXBC)

Baylake Corp (BYLK)

Benton Financial (BTOF)

Florida Community Banks (FLCM)

Greater Sacramento Bancorp (GSCB)

Stonegate Bank (SGBK)

Bank of Santa Clarita (BSCA)

Please understand I am not saying you should short these names. I know very little about most of them.

Posted by

TJF

at

8:36 AM

0

comments

![]()

Labels: SEC, Securities and Exchange Commission, Short Selling

SEC Bans Short Selling

The Securities and Exchange Commission (SEC) bans short selling in 799 financial stocks through October 2, 2008. The SEC has this authority under Section 12(k)(2) of the Securities Exchange Act of 1934.

Just to demonstrate how quickly the order was prepared, they included National Atlantic Holdings Corp (NAHC), a company that was bought out several months ago.

Some excerpts from the SEC order.

"Recent market conditions have made us concerned that short selling in the securities of a wider range of financial institutions may be causing sudden and excessive fluctuations of the prices of such securities in such a manner so as to threaten fair and orderly markets."

"This emergency action should prevent short selling from being used to drive down the share prices of issuers even where there is no fundamental basis for a price decline other than general market conditions."

"The following entities are excepted from the requirements of the Order: registered market makers, block positioners, or other market makers obligated to quote in the over-the-counter market."

The order covers SIC codes 6000, 6011, 6020-22, 6025, 6030, 6035-36, 6111, 6140, 6144, 6200, 6210-11, 6231, 6282, 6305, 6310-11, 6320-21, 6324, 6330-31, 6350-51, 6360-61, 6712, and 6719.

The Full List

AAME ATLANTIC AMERICAN CORP

AANB ABIGAIL ADAMS NATL BANCORP INC

ABBC ABINGTON BANCORP INC PA

ABCB AMERIS BANCORP

ABCW ANCHOR BANCORP WISCONSIN INC

ABK AMBAC FINANCIAL GROUP INC

ABNJ AMERICAN BANCORP OF NJ INC

ABVA ALLIANCE BANKSHARES CORP

ACAP AMERICAN PHYSICIANS CAPITAL INC

ACBA AMERICAN COMMUNITY BNCSHRS INC

ACE ACE LTD

ACFC ATLANTIC COAST FED CORP

ACGL ARCH CAPITAL GROUP LTD NEW

ADVNA ADVANTA CORP

ADVNB ADVANTA CORP

AEG AEGON N V

AEL AMERICAN EQUITY INVT LIFE HLDG C

AET AETNA INC NEW

AF ASTORIA FINANCIAL CORP

AFFM AFFIRMATIVE INSURANCE HLDGS INC

AFG AMERICAN FINANCIAL GROUP INC NEW

AFL A F L A C INC

AGII ARGO GROUP INTL HLDGS LTD

AGO ASSURED GUARANTY LTD

AGP AMERIGROUP CORP

AGX ARGAN INC

AHD ATLAS PIPELINE HOLDINGS L P

AHL ASPEN INSURANCE HOLDINGS LTD

AIB ALLIED IRISH BANKS PLC

AIG AMERICAN INTERNATIONAL GROUP

AINV APOLLO INVESTMENT CORP

AIZ ASSURANT INC

ALL ALLSTATE CORP

ALLB ALLIANCE BANCORP INC PA

ALNC ALLIANCE FINANCIAL CORP NY

AMCP AMCOMP INC NEW

AMFI AMCORE FINANCIAL INC

AMG AFFILIATED MANAGERS GROUP INC

AMIC AMERICAN INDEPENDENCE CORP

AMNB AMERICAN NATIONAL BANKSHARES INC

AMP AMERIPRISE FINANCIAL INC

AMPH AMERICAN PHYSICIANS SVC GROUP

AMRB AMERICAN RIVER BANKSHARES

AMSF AMERISAFE INC

AMTD T D AMERITRADE HOLDING CORP

ANAT AMERICAN NATIONAL INS CO

ANNB ANNAPOLIS BANCORP INC

AOC AON CORP

APAB APPALACHIAN BANCSHARES INC

AROW ARROW FINANCIAL CORP

ASBI AMERIANA BANCORP

ASFI ASTA FUNDING INC

ASFN ATLANTIC SOUTHERN FINL GROUP INC

ASRV AMERISERV FINANCIAL INC

ATBC ATLANTIC BANCGROUP INC

ATLO AMES NATL CORP

AUBN AUBURN NATIONAL BANCORP

AWBC AMERICAN WEST BANCORPORATION

AWH ALLIED WORLD ASSUR CO HLDGS LTD

AXA A X A UAP

AXG ATLAS ACQUISITION HOLDINGS CORP

AXS AXIS CAPITAL HOLDINGS LTD

BAC BANK OF AMERICA CORP

BANF BANCFIRST CORP

BANR BANNER CORP

BARI BANCORP RHODE ISLAND INC

BAYN BAY NATIONAL CORP

BBNK BRIDGE CAPITAL HOLDINGS

BBT B B & T CORP

BBX BANKATLANTIC BANCORP INC

BCA CORPBANCA

BCAR BANK OF THE CAROLINAS CORP

BCBP B C B BANCORP INC

BCP BROOKE CAPITAL CORP

BCS BARCLAYS PLC

BCSB B C S B BANCORP INC

BDGE BRIDGE BANCORP INC

BEN FRANKLIN RESOURCES INC

BERK BERKSHIRE BANCORP INC DEL

BFF B F C FINANCIAL CORP

BFIN BANKFINACIAL CORP

BFNB BEACH FIRST NATL BANCSHARES INC

BHB BAR HARBOR BANKSHARES

BHBC BEVERLY HILLS BANCORP INC

BHLB BERKSHIRE HILLS BANCORP INC

BK BANK OF NEW YORK MELLON CORP

BKBK BRITTON & KOONTZ CAPITAL CORP

BKMU BANK MUTUAL CORP NEW

BKOR OAK RIDGE FINANCIAL SERVICES INC

BKSC BANK SOUTH CAROLINA CORP

BKUNA BANKUNITED FINANCIAL CORP

BLX BANCO LATINOAMERICANO DE EXP SA

BMRC BANK OF MARIN BANCORP

BMTC BRYN MAWR BANK CORP

BNCL BENEFICIAL MUTUAL BANCORP INC

BNCN B N C BANCORP

BNS BANK OF NOVA SCOTIA

BNV BEVERLY NATIONAL CORP

BOCH BANK OF COMMERCE HOLDINGS

BOFI B OF I HOLDING INC

BOFL BANK OF FLORIDA CORP NAPLES

BOH BANK OF HAWAII CORP

BOKF B O K FINANCIAL CORP

BOMK BANK MCKENNEY VA

BOVA BANK OF VIRGINIA

BPFH BOSTON PRIVATE FINL HLDS INC

BPSG BROADPOINT SECURITIES GROUP INC

BRK BERKSHIRE HATHAWAY INC DEL

BRK BERKSHIRE HATHAWAY INC DEL

BRKL BROOKLINE BANCORP INC

BSRR SIERRA BANCORP

BTFG BANCTRUST FINANCIAL GROUP INC

BUSE FIRST BUSEY CORP

BWINA BALDWIN AND LYONS INC

BWINB BALDWIN AND LYONS INC

BX BLACKSTONE GROUP L P

BXS BANCORPSOUTH INC

BYFC BROADWAY FINANCIAL CORP DEL

C CITIGROUP INC

CAC CAMDEN NATIONAL CORP

CACB CASCADE BANCORP

CADE CADENCE FINANCIAL CORP

CAFI CAMCO FINANCIAL CORP

CAPB CAPITALSOUTH BANCORP

CAPE CAPE FEAR BANK CORP

CART CAROLINA TRUST BANK

CARV CARVER BANCORP INC

CASB CASCADE FINANCIAL CORP

CASH META FINANCIAL GROUP INC

CATY CATHAY GENERAL BANCORP

CB CHUBB CORP

CBAN COLONY BANKCORP INC

CBBO COLUMBIA BANCORP ORE

CBC CAPITOL BANCORP LTD

CBIN COMMUNITY BANK SHRS INDIANA INC

CBKN CAPITAL BANK CORP NEW

CBNK CHICOPEE BANCORP INC

CBON COMMUNITY BANCORP

CBU COMMUNITY BANK SYSTEM INC

CCBD COMMUNITY CENTRAL BANK CORP

CCBG CAPITAL CITY BANK GROUP

CCBP COMM BANCORP INC

CCFH C C F HOLDING COMPANY

CCNE C N B FINANCIAL CORP PA

CCOW CAPITAL CORP OF THE WEST

CEBK CENTRAL BANCORP INC

CFBK CENTRAL FEDERAL CORP

CFFC COMMUNITY FINANCIAL CORP

CFFI C AND F FINANCIAL CORP

CFFN CAPITOL FEDERAL FINANCIAL

CFNL CARDINAL FINANCIAL CORP

CFR CULLEN FROST BANKERS INC

CHCO CITY HOLDING CO

CHEV CHEVIOT FINANCIAL CORP

CHFC CHEMICAL FINANCIAL CORP

CI C I G N A CORP

CIA CITIZENS INC

CINF CINCINNATI FINANCIAL CORP

CITZ C F S BANCORP INC

CIZN CITIZENS HOLDING CO

CJBK CENTRAL JERSEY BANCORP

CLBH CAROLINA BANK HOLDINGS INC

CLFC CENTER FINANCIAL CORP

CLMS CALAMOS ASSET MANAGEMENT INC

CMA COMERICA INC

CME C M E GROUP INC

CMFB COMMERCEFIRST BANCORP INC

CMGI C M G I INC

CMSB C M S BANCORP INC

CNA C N A FINANCIAL CORP

CNAF COMMERCIAL NATIONAL FINL CORP

CNB COLONIAL BANCGROUP INC

CNBC CENTER BANCORP INC

CNBKA CENTURY BANCORP INC

CNC CENTENE CORP DEL

CNLA COMMUNITY NATL BANK LAKEWAY AREA

CNO CONSECO INC

CNS COHEN & STEERS INC

COBH PENNSYLVANIA COMMERCE BANCORP IN

COBZ COBIZ FINANCIAL INC

COLB COLUMBIA BANKING SYSTEM INC

COOP COOPERATIVE BANCSHARES INC

CORS CORUS BANKSHARES INC

COWN COWEN GROUP INC

CPBC COMMUNITY PARTNERS BANCORP

CPBK COMMUNITY CAPITAL CORP

CPF CENTRAL PACIFIC FINANCIAL CORP

CPHL CASTLEPOINT HOLDINGS LTD

CRBC CITIZENS REPUBLIC BANCORP INC

CRFN CRESCENT FINANCIAL CORP

CRMH C R M HOLDINGS LTD

CRRB CARROLLTON BANCORP

CRVL CORVEL CORP

CSBC CITIZENS SOUTH BANKING CORP DEL

CSBK CLIFTON SAVINGS BANCORP INC

CSFL CENTERSTATE BANKS OF FLORIDA INC

CSHB COMMUNITY SHORES BANK CORP

CSNT CRESCENT BANKING CO

CTBC CONNECTICUT BANK & TRUST CO

CTBI COMMUNITY TRUST BANCORP INC

CTBK CITYBANK LYNNWOOD WASHINGTON

CTZN CITIZENS FIRST BANCORP INC

CVBF C V B FINANCIAL CORP

CVBK CENTRAL VIRGINIA BANKSHARES INC

CVCY CENTRAL VALLEY COMM BANCORP

CVH COVENTRY HEALTH CARE INC

CVLL COMMUNITY VALLEY BANCORP

CVLY CODORUS VALLEY BANCORP INC

CWBC COMMUNITY WEST BANCSHARES

CWBS COMMONWEALTH BANKSHARES INC

CWLZ COWLITZ BANCORPORATION

CZFC CITIZENS FIRST CORP

CZWI CITIZENS CMNTY BANCORP INC MD

DB DEUTSCHE BANK AG

DCOM DIME COMMUNITY BANCSHARES

DEAR DEARBORN BANCORP INC

DFG DELPHI FINANCIAL GROUP INC

DGICA DONEGAL GROUP INC

DGICB DONEGAL GROUP INC

DHIL DIAMOND HILL INVESTMENT GRP INC

DLLR DOLLAR FINANCIAL CORP

DR DARWIN PROFESSIONAL UNDERWRITERS

DSL DOWNEY FINANCIAL CORP

DUF DUFF AND PHELPS CORP NEW

EBSB MERIDIAN INTERSTATE BANCORP INC

EBTX ENCORE BANCSHRES INC

ECBE E C B BANCORP INC

EGBN EAGLE BANCORP INC

EIHI EASTERN INSURANCE HOLDINGS INC

EII ENERGY INFRASTRUCTURE ACQUI CORP

EMCI E M C INSURANCE GROUP INC

EMITF ELBIT IMAGING LTD

ENH ENDURANCE SPECIALTY HOLDINGS LTD

ESBF E S B FINANCIAL CORP

ESBK ELMIRA SAVINGS BANK FSB NY

ESGR ENSTAR GROUP LTD

ETFC E TRADE FINANCIAL CORP

EV EATON VANCE CORP

EVBN EVANS BANCORP INC

EVBS EASTERN VIRGINIA BANKSHARES INC

EVR EVERCORE PARTNERS INC

EWBC EAST WEST BANCORP INC

FABK FIRST ADVANTAGE BANCORP

FAC FIRST ACCEPTANCE CORP

FAF FIRST AMERICAN CORP CALIF

FBC FLAGSTAR BANCORP INC

FBCM F B R CAPITAL MARKETS CORP

FBIZ FIRST BUSINESS FINL SVCS INC

FBMI FIRSTBANK CORP

FBMS FIRST BANCSHARES INC MS

FBNC FIRST BANCORP NC

FBP FIRST BANCORP P R

FBSI FIRST BANCSHARES INC MO

FBSS FAUQUIER BANKSHARES INC

FBTC FIRST BANCTRUST

FCAL FIRST CALIFORNIA FINL GROUP INC

FCAP FIRST CAPITAL INC

FCBC FIRST COMMUNITY BANCSHARES INC

FCCO FIRST COMMUNITY CORP SC

FCCY 1ST CONSTITUTION BANCORP

FCFL FIRST COMMUNITY BANK CORP AMER

FCNCA FIRST CITIZENS BANCSHARES INC NC

FCVA FIRST CAPITAL BANCORP INC VA

FCZA FIRST CITIZENS BANC CORP

FDEF FIRST DEFIANCE FINANCIAL CORP

FDT FEDERAL TRUST CORP

FED FIRSTFED FINANCIAL CORP

FFBC FIRST FINANCIAL BANCORP OHIO

FFBH FIRST FEDERAL BANCSHARES ARK INC

FFCH FIRST FINANCIAL HOLDINGS INC

FFCO FEDFIRST FINANCIAL CORP

FFDF F F D FINANCIAL CORP

FFFD NORTH CENTRAL BANCSHARES INC

FFG F B L FINANCIAL GROUP INC

FFH FAIRFAX FINL HOLDINGS LTD

FFHS FIRST FRANKLIN CORP

FFIC FLUSHING FINANCIAL CORP

FFIN FIRST FINANCIAL BANKSHARES INC

FFKT FARMERS CAPITAL BANK CORP

FFKY FIRST FINANCIAL SERVICE CORP

FFNM FIRST FED NORTHN MI BANCORP INC

FFNW FIRST FINANCIAL NORTHWEST INC

FFSX FIRST FEDERAL BANKSHARES INC DEL

FHN FIRST HORIZON NATIONAL CORP

FIFG 1ST INDEPENDENCE FNL GROUP INC

FIG FORTRESS INVESTMENT GROUP L L C

FII FEDERATED INVESTORS INC PA

FISI FINANCIAL INSTITUTIONS INC

FKFS FIRST KEYSTONE FINANCIAL INC

FLIC FIRST LONG ISLAND CORP

FMAR FIRST MARINER BANCORP

FMBI FIRST MIDWEST BANCORP DE

FMER FIRSTMERIT CORP

FMFC FIRST M AND F CORP

FNB F N B CORP PA

FNBN F N B UNITED CORP

FNFG FIRST NIAGARA FINL GROUP INC NEW

FNLC FIRST BANCORP INC ME

FNM FEDERAL NATIONAL MORTGAGE ASSN

FNSC FIRST NATIONAL BANCSHARES INC SC

FPBI F P B BANCORP INC

FPBN 1ST PACIFIC BANCORP CA

FPFC FIRST PLACE FINANCIAL CORP NM

FPIC F P I C INSURANCE GROUP INC

FPTB FIRST PACTRUST BANCORP INC

FRBK REPUBLIC FIRST BANCORP INC

FRE FEDERAL HOME LOAN MORTGAGE CORP

FRGB FIRST REGIONAL BANCORP

FRME FIRST MERCHANTS CORP

FSBI FIDELITY BANCORP INC

FSBK FIRST SOUTH BANCORP INC

FSGI FIRST SECURITY GROUP INC

FSNM FIRST STATE BANCORPORATION

FTBK FRONTIER FINANCIAL CORP

FULT FULTON FINANCIAL CORP PA

FUNC FIRST UNITED CORP

FWV FIRST WEST VIRGINIA BANCORP INC

FXCB FOX CHASE BANCORP INC

GABC GERMAN AMERICAN BANCORP INC

GAN GAINSCO INC

GBCI GLACIER BANCORP INC NEW

GBH GREEN BUILDERS INC

GBL GAMCO INVESTORS INC

GBNK GUARANTY BANCORP

GBTS GATEWAY FINANCIAL HLDGS INC

GCA GLOBAL CASH ACCESS HOLDINGS INC

GFED GUARANTY FEDERAL BANCSHARES INC

GFIG G F I GROUP INC

GFLB GREAT FLORIDA BANK

GGAL GRUPO FINANCIERO GALICIA S A

GHL GREENHILL AND CO INC

GIW WILBER CORP

GLBZ GLEN BURNIE BANCORP

GLRE GREENLIGHT CAPITAL RE LTD

GNW GENWORTH FINANCIAL INC

GOV GOUVERNEUR BANCORP INC

GRAN BANK GRANITE CORP

GRNB GREEN BANKSHARES INC

GROW U S GLOBAL INVESTORS INC

GS GOLDMAN SACHS GROUP INC

GSBC GREAT SOUTHERN BANCORP INC

GSLA G S FINANCIAL CORP

GTS TRIPLE S MANAGEMENT CORP

HABC HABERSHAM BANCORP INC

HAFC HANMI FINANCIAL CORP

HALL HALLMARK FINANCIAL SERVICES INC

HARL HARLEYSVILLE SAVINGS FINAN CORP

HAXS HEALTHAXIS INC

HBAN HUNTINGTON BANCSHARES INC

HBHC HANCOCK HOLDING CO

HBNK HAMPDEN BANCORP INC

HBOS HERITAGE FINANCIAL GROUP

HCBK HUDSON CITY BANCORP INC

HCC H C C INSURANCE HOLDINGS INC

HEOP HERITAGE OAKS BANCORP

HFBC HOPFED BANCORP INC

HFFC H F FINANCIAL CORP

HFWA HERITAGE FINANCIAL CORP WA

HGIC HARLEYSVILLE GROUP INC

HIFS HINGHAM INSTITUTION FOR SVGS MA

HMN HORACE MANN EDUCATORS CORP NEW

HMNF H M N FINANCIAL INC

HMPR HAMPTON ROADS BANKSHARES INC

HNBC HARLEYSVILLE NATIONAL CORP PA

HNT HEALTH NET INC

HOMB HOME BANCSHARES INC

HOME HOME FEDERAL BANCORP INC MD

HRZB HORIZON FINANCIAL CORP WASH

HS HEALTHSPRING INC

HTBK HERITAGE COMMERCE CORP

HTH HILLTOP HOLDINGS INC

HTLF HEARTLAND FINANCIAL USA INC

HUM HUMANA INC

HWBK HAWTHORN BANCSHARES INC

HWFG HARRINGTON WEST FINANCIAL GRP IN

IAAC INTERNATIONAL ASSETS HLDG CORP

IBCA INTERVEST BANCSHARES CORP

IBCP INDEPENDENT BANK CORP MICH

IBKC IBERIABANK CORP

IBKR INTERACTIVE BROKERS GROUP INC

IBNK INTEGRA BANK CORP

IBOC INTERNATIONAL BANCSHARES CORP

ICE INTERCONTINENTALEXCHANGE INC

ICH INVESTORS CAPITAL HOLDINGS LTD

IFC IRWIN FINANCIAL CORP

IFSB INDEPENDENCE FEDERAL SAVINGS BK

IHC INDEPENDENCE HOLDING CO NEW

IMP IMPERIAL CAPITAL BANCORP INC

INCB INDIANA COMMUNITY BANCORP

INDB INDEPENDENT BANK CORP MA

ING I N G GROEP N V

IPCC INFINITY PROPERTY & CASUALTY COR

IPCR I P C HOLDINGS LTD

IRE IRELAND BANK

ITC I T C HOLDINGS CORP

ITG INVESTMENT TECHNOLOGY GP INC

ITIC INVESTORS TITLE CO

JAXB JACKSONVILLE BANCORP INC FL

JEF JEFFERIES GROUP INC NEW

JFBC JEFFERSONVILLE BANCORP

JFBI JEFFERSON BANCSHARES INC TENN

JLI JESUP & LAMONT INC

JMP J M P GROUP INC

JNS JANUS CAP GROUP INC

JPM JPMORGAN CHASE & CO

JXSB JACKSONVILLE BANCORP INC

KCLI KANSAS CITY LIFE INS CO

KENT KENT FINANCIAL SERVICES INC

KEY KEYCORP NEW

KFED K FED BANCORP

KFFB KENTUCKY FIRST FEDERAL BANCORP

KFS KINGSWAY FINANCIAL SERVICES INC

KRNY KEARNY FINANCIAL CORP

L LOEWS CORP

LAB LABRANCHE AND CO INC

LABC LOUISIANA BANCORP INC

LARK LANDMARK BANCORP INC

LAZ LAZARD LTD

LBBB LIBERTY BELL BK CHERRY HILL NJ

LBCP LIBERTY BANCORP INC MO

LEGC LEGACY BANCORP INC

LEH LEHMAN BROTHERS HOLDINGS INC

LFC CHINA LIFE INSURANCE CO LTD

LION FIDELITY SOUTHERN CORP NEW

LKFN LAKELAND FINANCIAL CORP

LNC LINCOLN NATIONAL CORP IN

LNCB LINCOLN BANCORP IND

LPSB LAPORTE BANCORP INC

LSBI L S B FINANCIAL CORP

LSBK LAKE SHORE BANCORP INC

LSBX L S B CORP

LTS LADENBURG THALMANN FIN SVCS INC

LUK LEUCADIA NATIONAL CORP

LYG LLOYDS TSB GROUP PLC

MAIN MAIN STREET CAPITAL CORP

MASB MASSBANK CORP

MBFI M B FINANCIAL INC NEW

MBHI MIDWEST BANC HOLDINGS INC

MBI M B I A INC

MBP MID PENN BANCORP INC

MBR MERCANTILE BANCORP INC

MBRG MIDDLEBURG FINANCIAL CORP

MBTF M B T FINANCIAL CORP

MBVA MILLENNIUM BANKSHARES CORP

MBVT MERCHANTS BANCSHARES INC

MBWM MERCANTILE BANK CORP

MCBF MONARCH COMMUNITY BANCORP INC

MCBI METROCORP BANCSHARES INC

MCGC M C G CAPITAL CORP

MCY MERCURY GENERAL CORP NEW

MER MERRILL LYNCH AND CO INC

MERR MERRIMAN CURHAN FORD GROUP INC

MF M F GLOBAL LTD

MFC MANULIFE FINANCIAL CORP

MFLR MAYFLOWER BANCORP INC

MFNC MACKINAC FINANCIAL CORP

MFSF MUTUALFIRST FINL INC

MGYR MAGYAR BANCORP INC

MHLD MAIDEN HOLDNGS LTD

MI MARSHALL AND ILSLEY CORP NEW

MIG MEADOWBROOK INSURANCE GROUP INC

MIGP MERCER INSURANCE GROUP INC

MKL MARKEL CORP

MKTX MARKETAXESS HLDGS INC

MNRK MONARCH FINANCIAL HOLDINGS INC

MOFG MIDWESTONE FINANCIAL GRP INC NEW

MOH MOLINA HEALTHCARE INC

MORN MORNINGSTAR INC

MRH MONTPELIER RES HOLDINGS LTD

MROE MONROE BANCORP

MS MORGAN STANLEY DEAN WITTER AND CO

MSBF M S B FINANCIAL CORP

MSFG MAINSOURCE FINANCIAL GROUP INC

MSL MIDSOUTH BANCORP INC

MTG M G I C INVESTMENT CORP WIS

MTU MITSUBISHI UFJ FINANCIAL GP INC

MXGL MAX CAPITAL GROUP LTD

NAHC NATIONAL ATLANTIC HOLDINGS CORP

NAL NEWALLIANCE BANCSHARES INC

NARA NARA BANCORP INC

NATL NATIONAL INTERSTATE CORP

NAVG NAVIGATORS GROUP INC

NBBC NEWBRIDGE BANCORP

NBN NORTHEAST BANCORP

NBTB N B T BANCORP INC

NBTF N B AND T FINANCIAL GROUP INC

NCBC NEW CENTURY BANCORP INC NC

NCC NATIONAL CITY CORP

NDAQ NASDAQ O M X GROUP INC

NEBS NEW ENGLAND BANCSHARES INC

NECB NORTHEAST COMMUNITY BANCORP INC

NEWT NEWTEK BUSINESS SVCS INC

NFBK NORTHFIELD BANCORP INC

NFS NATIONWIDE FINANCIAL SERVICES IN

NFSB NEWPORT BANCORP INC

NHTB NEW HAMPSHIRE THRIFT BNCSHRS INC

NICK NICHOLAS FINANCIAL INC

NITE KNIGHT CAPITAL GROUP INC

NKSH NATIONAL BANKSHARES INC

NMR NOMURA HOLDINGS INC

NMX NYMEX HOLDINGS INC

NOVB NORTH VALLEY BANCORP

NPBC NATIONAL PENN BANCSHARES INC

NRIM NORTHRIM BANCORP INC

NSEC NATIONAL SECURITY GROUP INC

NSFC NORTHERN STATES FINANCIAL CORP

NSH NUSTAR G P HOLDINGS LLC

NTQ N T R ACQUISITION CO

NTRS NORTHERN TRUST CORP

NVSL NAUGATUCK VLY FINANCIAL CORP

NWFL NORWOOD FINANCIAL CORP

NWLIA NATIONAL WESTERN LIFE INS CO

NWSB NORTHWEST BANCORP INC PA

NXTY NEXITY FINANCIAL CORP

NYB NEW YORK COMMUNITY BANCORP INC

NYM N Y M A G I C INC

NYX N Y S E EURONEXT

OCFC OCEANFIRST FINANCIAL CORP

OFG ORIENTAL FINANCIAL GROUP INC

OKSB SOUTHWEST BANCORP INC OKLA

OLBK OLD LINE BANCSHARES

OLCB OHIO LEGACY CORP

ONB OLD NATIONAL BANCORP

ONFC ONEIDA FINANCIAL CORP

OPHC OPTIMUMBANK HOLDINGS INC

OPOF OLD POINT FINL CORP

OPY OPPENHEIMER HOLDINGS INC

ORH ODYSSEY RE HOLDINGS CORP

ORI OLD REPUBLIC INTERNATIONAL CORP

ORIT ORITANI FINANCIAL CORP

OSBC OLD SECOND BANCORP INC

OSBK OSAGE BANCSHARES INC

OSHC OCEAN SHORE HOLDING CO

OVBC OHIO VALLEY BANC CORP

OXPS OPTIONSXPRESS HOLDINGS INC

OZM OCH ZIFF CAPITAL MANGMNT GRP LLC

OZRK BANK OF THE OZARKS INC

PABK P A B BANKSHARES INC

PACW PACWEST BANCORP DE

PBCI PAMRAPO BANCORP INC

PBCT PEOPLES UNITED FINANCIAL INC

PBHC PATHFINDER BANCORP INC

PBIB PORTER BANCORP INC

PBIP PRUDENTIAL BANCORP INC PA

PBKS PROVIDENT BANKSHARES CORP

PBNY PROVIDENT NEW YORK BANCORP

PCBC PACIFIC CAPITAL BANCORP NEW

PCBI PEOPLES COMMUNITY BANCORP INC

PCBK PACIFIC CONTINENTAL CORP

PCBS PROVIDENT COMMUNITY BANCSHRS INC

PEBK PEOPLES BANCORP NC INC

PEBO PEOPLES BANCORP INC

PFBC PREFERRED BANK LOS ANGELES

PFBI PREMIER FINANCIAL BANCORP INC

PFBX PEOPLES FINANCIAL CORP

PFED PARK BANCORP INC

PFG PRINCIPAL FINANCIAL GROUP INC

PFS PROVIDENT FINANCIAL SVCS INC

PGR PROGRESSIVE CORP OH

PHLY PHILADELPHIA CONSOLIDATED HLG CO

PICO P I C O HOLDINGS INC

PJC PIPER JAFFRAY COMPANIES

PKBK PARKE BANCORP INC

PL PROTECTIVE LIFE CORP

PLCC PAULSON CAPITAL CORP

PLFE PRESIDENTIAL LIFE CORP

PMACA P M A CAPITAL CORP

PMBC PACIFIC MERCANTILE BANCORP

PMI P M I GROUP INC

PNBC PRINCETON NATIONAL BANCORP INC

PNBK PATRIOT NATIONAL BANCORP INC

PNC P N C FINANCIAL SERVICES GRP INC

PNFP PINNACLE FINANCIAL PARTNERS INC

PNSN PENSON WORLDWIDE INC

PNX PHOENIX COS INC

PPBI PACIFIC PREMIER BANCORP INC

PRA PROASSURANCE CORP

PRE PARTNERRE LTD

PRK PARK NATIONAL CORP

PROS PROCENTURY CORP

PROV PROVIDENT FINANCIAL HOLDINGS INC

PRSP PROSPERITY BANCSHARES INC

PRU PRUDENTIAL FINANCIAL INC

PRWT PREMIERWEST BANCORP

PSBC PACIFIC STATE BANCORP

PSBH PSB HOLDINGS INC

PSEC PROSPECT CAPITAL CORP

PTA PENN TREATY AMERICAN CORP

PTP PLATINUM UNDERWRITERS HLDGS LTD

PUK PRUDENTIAL PLC

PULB PULASKI FINANCIAL CORP

PVFC P V F CAPITAL CORP

PVSA PARKVALE FINANCIAL CORP

PVTB PRIVATEBANCORP INC

PWOD PENNS WOODS BANCORP INC

PZN PZENA INVESTMENT MANAGEMENT INC

QCRH Q C R HOLDINGS INC

QNTA QUANTA CAPITAL HOLDINGS LTD

RAMR R A M HOLDINGS LTD

RBCAA REPUBLIC BANCORP INC KY

RBNF RURBAN FINANCIAL CORP

RBPAA ROYAL BANCSHARES PA INC

RBS ROYAL BANK SCOTLAND GROUP PLC

RCBK RIVER CITY BANK

RCKB ROCKVILLE FINANCIAL INC

RDN RADIAN GROUP INC

RE EVEREST RE GROUP LTD

RF REGIONS FINANCIAL CORP NEW

RGA REINSURANCE GROUP OF AMERICA INC

RIVR RIVER VALLEY BANCORP

RJF RAYMOND JAMES FINANCIAL INC

RKH REGIONAL BANK HOLDRS TRUST

RLI R L I CORP

RNR RENAISSANCERE HOLDINGS LTD

RNST RENASANT CORP

RODM RODMAN & RENSHAW CAP GRP INC NEW

ROMA ROMA FINANCIAL CORP

ROME ROME BANCORP INC

RPFG RAINIER PACIFIC FINL GROUP INC

RVSB RIVERVIEW BANCORP INC

RY ROYAL BANK CANADA MONTREAL QUE

SAF SAFECO CORP

SAFT SAFETY INSURANCE GROUP INC

SAL SALISBURY BANCORP INC

SAMB SUN AMERICAN BANCORP

SASR SANDY SPRING BANCORP INC

SAVB SAVANNAH BANCORP INC

SBBX SUSSEX BANCORP

SBCF SEACOAST BANKING CORP FLA

SBIB STERLING BANCSHARES INC

SBKC SECURITY BANK CORP

SBNY SIGNATURE BANK NEW YORK N Y

SBP SANTANDER BANCORP

SBSI SOUTHSIDE BANCSHARES INC

SCA SECURITY CAPITAL ASSURANCE LTD

SCB COMMUNITY BANKSHARES INC S C

SCBT S C B T FINANCIAL CORP

SCHW SCHWAB CHARLES CORP NEW

SCMF SOUTHERN COMMUNITY FINCL CORP

SEAB SEABRIGHT INSURANCE HOLDINGS INC

SF STIFEL FINANCIAL CORP

SFG STANCORP FINANCIAL GROUP INC

SFNC SIMMONS 1ST NATIONAL CORP

SFST SOUTHERN FIRST BANCSHARES INC

SGB SOUTHWEST GEORGIA FINANCIAL CORP

SHG SHINHAN FINANCIAL GROUP CO LTD

SIEB SIEBERT FINANCIAL CORP

SIFI SI FINANCIAL GROUP INC

SIGI SELECTIVE INSURANCE GROUP INC

SIVB S V B FINANCIAL GROUP